Page 42 - GrapevineFY24 Adopted Budget

P. 42

During the same period, the City has also issued certificates of obligation (CO) debt of $80 million

to finance vehicle and capital equipment replacements, computers, golf carts, land acquisitions,

construction of the CVB Headquarters & Museum Complex, improvements at the Vineyards

Campground, and for the purchase of mobile electronic hand-held ticket writers. The debt has

been issued through both negotiated and competitive sales. The notes are issued in denominations

of $5,000 each. Interest is paid semi-annually on February 15 and August 15.

In August 2021 the City issued $11 million in Combination Tax and Revenue Certificates of

Obligation for the purpose of :

(a) designing, developing, constructing, improving, extending and expanding streets,

thoroughfares, sidewalks and bridges of the City, including streetscaping, streetlighting, right-of-

way protection, utility relocation and related storm drainage improvements; and acquiring rights-

of-way in connection therewith;

(b) designing, developing and acquiring information technology systems and equipment;

(c) designing, developing, constructing, improving, and renovating existing City buildings and

facilities, including City Hall, public safety, library, park and recreation, convention and visitor’s

bureau and service center buildings and facilities;

(d) acquiring vehicles and equipment for police, fire, emergency services, public works,

utilities and park and recreation purposes;

(e) professional services of attorneys, financial advisors, and other professionals incurred in

connection with items 'a' through 'e' and paying the costs incurred in connection with the issuance

of the Certificates.

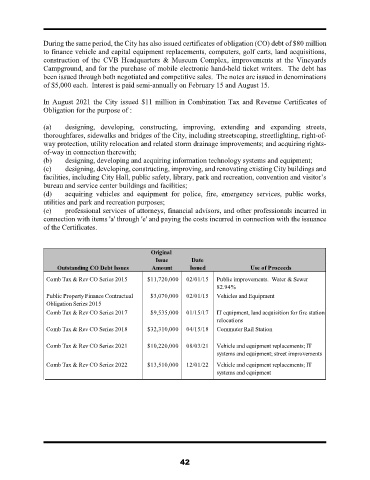

Original

Issue Date

Outstanding CO Debt Issues Amount Issued Use of Proceeds

Comb Tax & Rev CO Series 2015 $11,720,000 02/01/15 Public improvements. Water & Sewer

82.94%

Public Property Finance Contractual $3,070,000 02/01/15 Vehicles and Equipment

Obligation Series 2015

Comb Tax & Rev CO Series 2017 $9,535,000 01/15/17 IT equipment, land acquisition for fire station

relocations

Comb Tax & Rev CO Series 2018 $32,310,000 04/15/18 Commuter Rail Station

Comb Tax & Rev CO Series 2021 $10,220,000 08/03/21 Vehicle and equipment replacements; IT

systems and equipment; street improvements

Comb Tax & Rev CO Series 2022 $13,510,000 12/01/22 Vehicle and equipment replacements; IT

systems and equipment

42