Page 131 - GrapevineFY24 Adopted Budget

P. 131

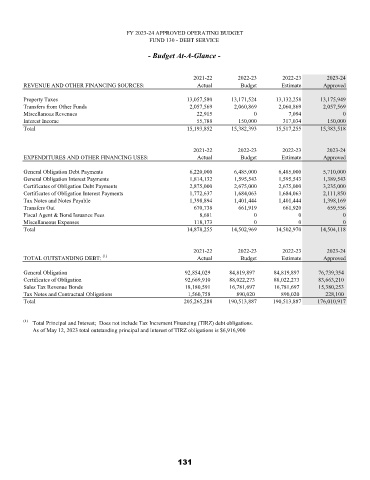

FY 2023-24 APPROVED OPERATING BUDGET

FUND 130 - DEBT SERVICE

- Budget At-A-Glance -

2021-22 2022-23 2022-23 2023-24

REVENUE AND OTHER FINANCING SOURCES: Actual Budget Estimate Approved

Property Taxes 13,057,580 13,171,524 13,132,258 13,175,949

Transfers from Other Funds 2,057,569 2,060,869 2,060,869 2,057,569

Miscellanous Revenues 22,915 0 7,094 0

Interest Income 55,788 150,000 317,034 150,000

Total 15,193,852 15,382,393 15,517,255 15,383,518

2021-22 2022-23 2022-23 2023-24

EXPENDITURES AND OTHER FINANCING USES: Actual Budget Estimate Approved

General Obligation Debt Payments 6,220,000 6,485,000 6,485,000 5,710,000

General Obligation Interest Payments 1,814,132 1,595,543 1,595,543 1,389,543

Certificates of Obligation Debt Payments 2,875,000 2,675,000 2,675,000 3,235,000

Certificates of Obligation Interest Payments 1,772,637 1,684,063 1,684,063 2,111,850

Tax Notes and Notes Payable 1,398,894 1,401,444 1,401,444 1,398,169

Transfers Out 670,738 661,919 661,920 659,556

Fiscal Agent & Bond Issuance Fees 8,681 0 0 0

Miscellaneous Expenses 118,173 0 0 0

Total 14,878,255 14,502,969 14,502,970 14,504,118

2021-22 2022-23 2022-23 2023-24

TOTAL OUTSTANDING DEBT: (1) Actual Budget Estimate Approved

General Obligation 92,854,029 84,819,897 84,819,897 76,739,354

Certificates of Obligation 92,669,910 88,022,273 88,022,273 83,663,210

Sales Tax Revenue Bonds 18,180,591 16,781,697 16,781,697 15,380,253

Tax Notes and Contractual Obligations 1,560,758 890,020 890,020 228,100

Total 205,265,288 190,513,887 190,513,887 176,010,917

(1) Total Principal and Interest; Does not include Tax Increment Financing (TIRZ) debt obligations.

As of May 12, 2023 total outstanding principal and interest of TIRZ obligations is $6,916,900

131