Page 192 - City of Fort Worth Budget Book

P. 192

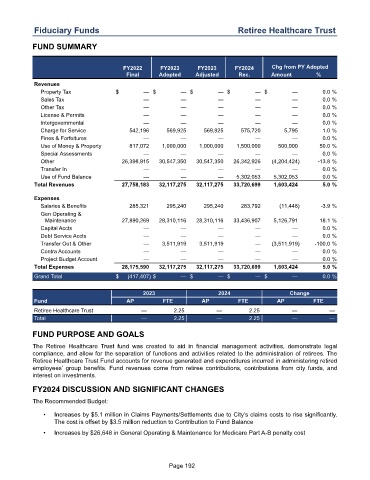

Fiduciary Funds Retiree Healthcare Trust

FUND SUMMARY

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — — — 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service 542,196 569,925 569,925 575,720 5,795 1.0 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property 817,072 1,000,000 1,000,000 1,500,000 500,000 50.0 %

Special Assessments — — — — — 0.0 %

Other 26,398,915 30,547,350 30,547,350 26,342,926 (4,204,424) -13.8 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — — — 5,302,053 5,302,053 0.0 %

Total Revenues 27,758,183 32,117,275 32,117,275 33,720,699 1,603,424 5.0 %

Expenses

Salaries & Benefits 285,321 295,240 295,240 283,792 (11,448) -3.9 %

Gen Operating &

Maintenance 27,890,269 28,310,116 28,310,116 33,436,907 5,126,791 18.1 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other — 3,511,919 3,511,919 — (3,511,919) -100.0 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses 28,175,590 32,117,275 32,117,275 33,720,699 1,603,424 5.0 %

Grand Total $ (417,407) $ — $ — $ — $ — 0.0 %

2023 2024 Change

Fund AP FTE AP FTE AP FTE

Retiree Healthcare Trust — 2.25 — 2.25 — —

Total — 2.25 — 2.25 — —

FUND PURPOSE AND GOALS

The Retiree Healthcare Trust fund was created to aid in financial management activities, demonstrate legal

compliance, and allow for the separation of functions and activities related to the administration of retirees. The

Retiree Healthcare Trust Fund accounts for revenue generated and expenditures incurred in administering retired

employees’ group benefits. Fund revenues come from retiree contributions, contributions from city funds, and

interest on investments.

FY2024 DISCUSSION AND SIGNIFICANT CHANGES

The Recommended Budget:

• Increases by $5.1 million in Claims Payments/Settlements due to City’s claims costs to rise significantly.

The cost is offset by $3.5 million reduction to Contribution to Fund Balance

• Increases by $26,648 in General Operating & Maintenance for Medicare Part A-B penalty cost

Page 192