Page 4 - NEXT YEAR BUDGET DETAIL REPORT

P. 4

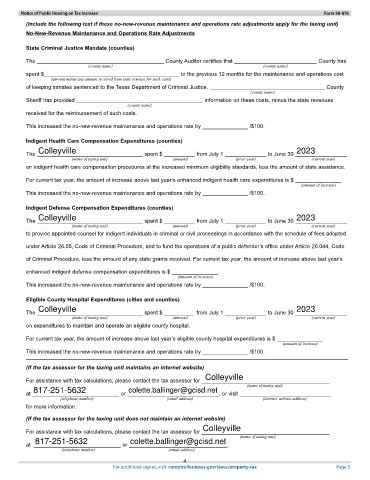

Notice of Public Hearing on Tax Increase Form 50-876

(Include the following text if these no-new-revenue maintenance and operations rate adjustments apply for the taxing unit)

No-New-Revenue Maintenance and Operations Rate Adjustments

State Criminal Justice Mandate (counties)

The County Auditor certifies that County has

(county name) (county name)

spent $ in the previous 12 months for the maintenance and operations cost

(amount minus any amount received from state revenue for such costs)

of keeping inmates sentenced to the Texas Department of Criminal Justice. County

(county name)

Sheriff has provided information on these costs, minus the state revenues

(county name)

received for the reimbursement of such costs.

This increased the no-new-revenue maintenance and operations rate by /$100.

Indigent Health Care Compensation Expenditures (counties)

The Colleyville spent $ from July 1 to June 30 2023

(name of taxing unit) (amount) (prior year) (current year)

on indigent health care compensation procedures at the increased minimum eligibility standards, less the amount of state assistance.

For current tax year, the amount of increase above last year’s enhanced indigent health care expenditures is $

(amount of increase)

This increased the no-new-revenue maintenance and operations rate by /$100.

Indigent Defense Compensation Expenditures (counties)

The Colleyville spent $ from July 1 to June 30 2023

(name of taxing unit) (amount) (prior year) (current year)

to provide appointed counsel for indigent individuals in criminal or civil proceedings in accordance with the schedule of fees adopted

under Article 26.05, Code of Criminal Procedure, and to fund the operations of a public defender’s office under Article 26.044, Code

of Criminal Procedure, less the amount of any state grants received. For current tax year, the amount of increase above last year’s

enhanced indigent defense compensation expenditures is $ .

(amount of increase)

This increased the no-new-revenue maintenance and operations rate by /$100.

Eligible County Hospital Expenditures (cities and counties)

The Colleyville spent $ from July 1 to June 30 2023

(name of taxing unit) (amount) (prior year) (current year)

on expenditures to maintain and operate an eligible county hospital.

For current tax year, the amount of increase above last year’s eligible county hospital expenditures is $

(amount of increase)

This increased the no-new-revenue maintenance and operations rate by /$100.

(If the tax assessor for the taxing unit maintains an internet website)

For assistance with tax calculations, please contact the tax assessor for Colleyville

(name of taxing unit)

at 817-251-5632 or colette.ballinger@gcisd.net , or visit

(telephone number) (email address) (internet website address)

for more information.

(If the tax assessor for the taxing unit does not maintain an internet website)

For assistance with tax calculations, please contact the tax assessor for Colleyville

(name of taxing unit)

at 817-251-5632 or colette.ballinger@gcisd.net .

(telephone number) (email address)

4

For additional copies, visit: comptroller.texas.gov/taxes/property-tax Page 3