Page 3 - NEXT YEAR BUDGET DETAIL REPORT

P. 3

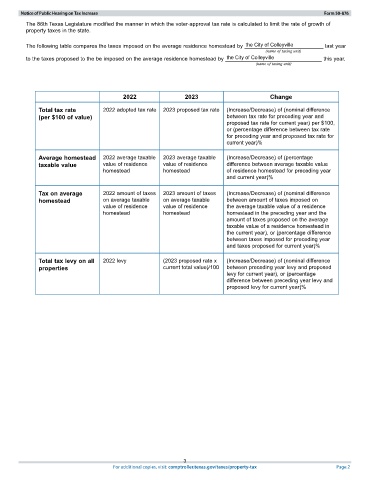

Notice of Public Hearing on Tax Increase Form 50-876

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of

property taxes in the state.

The following table compares the taxes imposed on the average residence homestead by the City of Colleyville last year

(name of taxing unit)

to the taxes proposed to the be imposed on the average residence homestead by the City of Colleyville this year.

(name of taxing unit)

2022 2023 Change

Total tax rate 2022 adopted tax rate 2023 proposed tax rate (Increase/Decrease) of (nominal difference

(per $100 of value) between tax rate for preceding year and

proposed tax rate for current year) per $100,

or (percentage difference between tax rate

for preceding year and proposed tax rate for

current year)%

Average homestead 2022 average taxable 2023 average taxable (Increase/Decrease) of (percentage

taxable value value of residence value of residence difference between average taxable value

homestead homestead of residence homestead for preceding year

and current year)%

Tax on average 2022 amount of taxes 2023 amount of taxes (Increase/Decrease) of (nominal difference

homestead on average taxable on average taxable between amount of taxes imposed on

value of residence value of residence the average taxable value of a residence

homestead homestead homestead in the preceding year and the

amount of taxes proposed on the average

taxable value of a residence homestead in

the current year), or (percentage difference

between taxes imposed for preceding year

and taxes proposed for current year)%

Total tax levy on all 2022 levy (2023 proposed rate x (Increase/Decrease) of (nominal difference

properties current total value)/100 between preceding year levy and proposed

levy for current year), or (percentage

difference between preceding year levy and

proposed levy for current year)%

3

For additional copies, visit: comptroller.texas.gov/taxes/property-tax Page 2