Page 13 - NEXT YEAR BUDGET DETAIL REPORT

P. 13

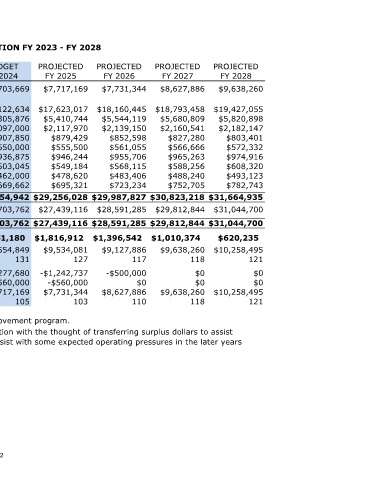

GENERAL FUND PROJECTION FY 2023 - FY 2028

BUDGET YE PROJECTED BUDGET PROJECTED PROJECTED PROJECTED PROJECTED

FY 2023 FY 2023 FY 2024 FY 2025 FY 2026 FY 2027 FY 2028

BEGINNING FUND BALANCE $7,703,669 $7,703,669 $7,703,669 $7,717,169 $7,731,344 $8,627,886 $9,638,260

REVENUE:

Ad Valorem Taxes $15,856,891 $15,818,646 $17,122,634 $17,623,017 $18,160,445 $18,793,458 $19,427,055

Sales Tax $4,910,000 $5,389,850 $5,305,876 $5,410,744 $5,544,119 $5,680,809 $5,820,898

Franchise Fees $1,947,000 $2,246,057 $2,097,000 $2,117,970 $2,139,150 $2,160,541 $2,182,147

Licenses & Permits $873,500 $781,138 $907,850 $879,429 $852,598 $827,280 $803,401

Fines $550,000 $476,701 $550,000 $555,500 $561,055 $566,666 $572,332

Charges for Service $865,875 $883,434 $936,875 $946,244 $955,706 $965,263 $974,916

Intergovernmental $490,508 $504,964 $503,045 $549,184 $568,115 $588,256 $608,320

Miscellaneous Income $198,000 $423,000 $462,000 $478,620 $483,406 $488,240 $493,123

Transfers In $536,011 $536,011 $669,662 $695,321 $723,234 $752,705 $782,743

TOTAL REVENUES $26,227,785 $27,059,800 $28,554,942 $29,256,028 $29,987,827 $30,823,218 $31,664,935

Expenditures $25,297,424 $24,962,763 $26,703,762 $27,439,116 $28,591,285 $29,812,844 $31,044,700

TOTAL EXPENDITURES $25,297,424 $24,962,763 $26,703,762 $27,439,116 $28,591,285 $29,812,844 $31,044,700

NET REVENUE $930,361 $2,097,037 $1,851,180 $1,816,912 $1,396,542 $1,010,374 $620,235

ENDING FUND BALANCE $8,634,030 $9,800,705 $9,554,849 $9,534,081 $9,127,886 $9,638,260 $10,258,495

DAYS OF FUND BALANCE 125 143 131 127 117 118 121

Transfer to CIP Fund* -$2,097,037 -$1,277,680 -$1,242,737 -$500,000 $0 $0

Transfer to Debt Service Fund** $0 -$560,000 -$560,000 $0 $0 $0

NEW ENDING BALANCE $8,634,030 $7,703,669 $7,717,169 $7,731,344 $8,627,886 $9,638,260 $10,258,495

Days of Fund Balance 125 113 105 103 110 118 121

*All General Fund surpluses will be utilized for the City's capital improvement program.

**For FY24, staff is proposing a larger increase in General Fund taxation with the thought of transferring surplus dollars to assist

with debt service payments. Staff believes this strategic move will assist with some expected operating pressures in the later years

of our forecast.

12