Page 29 - BurlesonFY24AdoptedBudget

P. 29

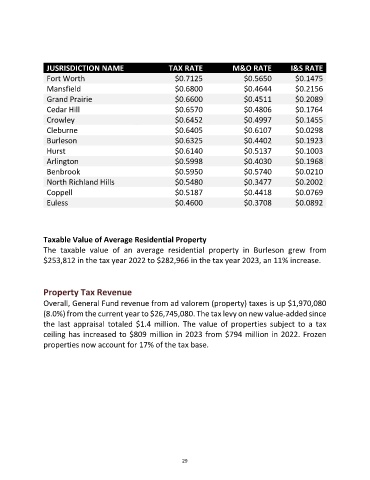

JUSRISDICTION NAME TAX RATE M&O RATE I&S RATE

Fort Worth $0.7125 $0.5650 $0.1475

Mansfield $0.6800 $0.4644 $0.2156

Grand Prairie $0.6600 $0.4511 $0.2089

Cedar Hill $0.6570 $0.4806 $0.1764

Crowley $0.6452 $0.4997 $0.1455

Cleburne $0.6405 $0.6107 $0.0298

Burleson $0.6325 $0.4402 $0.1923

Hurst $0.6140 $0.5137 $0.1003

Arlington $0.5998 $0.4030 $0.1968

Benbrook $0.5950 $0.5740 $0.0210

North Richland Hills $0.5480 $0.3477 $0.2002

Coppell $0.5187 $0.4418 $0.0769

Euless $0.4600 $0.3708 $0.0892

Taxable Value of Average Residential Property

The taxable value of an average residential property in Burleson grew from

$253,812 in the tax year 2022 to $282,966 in the tax year 2023, an 11% increase.

Property Tax Revenue

Overall, General Fund revenue from ad valorem (property) taxes is up $1,970,080

(8.0%) from the current year to $26,745,080. The tax levy on new value-added since

the last appraisal totaled $1.4 million. The value of properties subject to a tax

ceiling has increased to $809 million in 2023 from $794 million in 2022. Frozen

properties now account for 17% of the tax base.

29

29