Page 115 - BurlesonFY24AdoptedBudget

P. 115

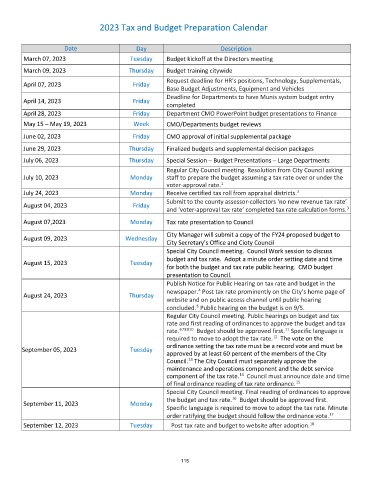

2023 Tax and Budget Preparation Calendar

Date Day Description

March 07, 2023 Tuesday Budget kickoff at the Directors meeting

March 09, 2023 Thursday Budget training citywide

Request deadline for HR’s positions, Technology, Supplementals,

April 07, 2023 Friday

Base Budget Adjustments, Equipment and Vehicles

Deadline for Departments to have Munis system budget entry

April 14, 2023 Friday

completed

April 28, 2023 Friday Department CMO PowerPoint budget presentations to Finance

May 15 – May 19, 2023 Week CMO/Departments budget reviews

June 02, 2023 Friday CMO approval of initial supplemental package

June 29, 2023 Thursday Finalized budgets and supplemental decision packages

July 06, 2023 Thursday Special Session – Budget Presentations – Large Departments

Regular City Council meeting. Resolution from City Council asking

July 10, 2023 Monday staff to prepare the budget assuming a tax rate over or under the

voter-approval rate.

1

July 24, 2023 Monday Receive certified tax roll from appraisal districts.

2

Submit to the county assessor-collectors ‘no new revenue tax rate’

August 04, 2023 Friday

3

and ‘voter-approval tax rate’ completed tax rate calculation forms.

August 07,2023 Monday Tax rate presentation to Council

City Manager will submit a copy of the FY24 proposed budget to

August 09, 2023 Wednesday

City Secretary’s Office and Cioty Council

Special City Council meeting. Council Work session to discuss

budget and tax rate. Adopt a minute order setting date and time

August 15, 2023 Tuesday

for both the budget and tax rate public hearing. CMO budget

presentation to Council.

Publish Notice for Public Hearing on tax rate and budget in the

newspaper. Post tax rate prominently on the City’s home page of

4

August 24, 2023 Thursday

website and on public access channel until public hearing

5

concluded. Public hearing on the budget is on 9/5.

Regular City Council meeting. Public hearings on budget and tax

rate and first reading of ordinances to approve the budget and tax

11

rate. 678910 Budget should be approved first. Specific language is

12

required to move to adopt the tax rate. The vote on the

ordinance setting the tax rate must be a record vote and must be

September 05, 2023 Tuesday

approved by at least 60 percent of the members of the City

13

Council. The City Council must separately approve the

maintenance and operations component and the debt service

component of the tax rate. Council must announce date and time

14

15

of final ordinance reading of tax rate ordinance.

Special City Council meeting. Final reading of ordinances to approve

16

the budget and tax rate. Budget should be approved first.

September 11, 2023 Monday

Specific language is required to move to adopt the tax rate. Minute

order ratifying the budget should follow the ordinance vote.

17

18

September 12, 2023 Tuesday Post tax rate and budget to website after adoption.

115

115