Page 475 - Southlake FY23 Budget

P. 475

APPEnDIx

TAx RATE ALLOCATIOn

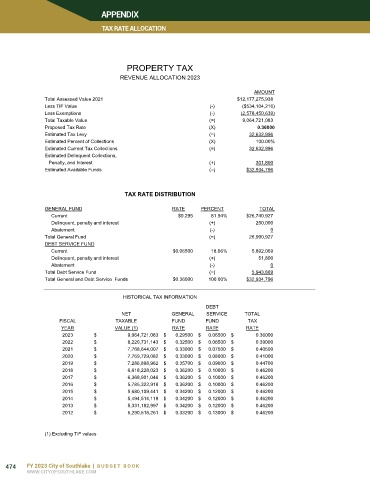

PROPERTY TAX

REVENUE ALLOCATION 2023

AMOUNT

Total Assessed Value 2021 $12,177,275,938

Less TIF Value (-) ($534,104,216)

Less Exemptions (-) (2,578,450,639)

Total Taxable Value (=) 9,064,721,083

Proposed Tax Rate (X) 0.36000

Estimated Tax Levy (=) 32,632,996

Estimated Percent of Collections (X) 100.00%

Estimated Current Tax Collections (=) 32,632,996

Estimated Delinquent Collections,

Penalty, and Interest (+) 301,800

Estimated Available Funds (=) $32,934,796

TAX RATE DISTRIBUTION

GENERAL FUND RATE PERCENT TOTAL

Current $0.295 81.94% $26,740,927

Delinquent, penalty and interest (+) 250,000

Abatement (-) 0

Total General Fund (=) 26,990,927

DEBT SERVICE FUND

Current $0.06500 18.06% 5,892,069

Delinquent, penalty and interest (+) 51,800

Abatement (-) 0

Total Debt Service Fund (=) 5,943,869

Total General and Debt Service Funds $0.36000 100.00% $32,934,796

HISTORICAL TAX INFORMATION

DEBT

NET GENERAL SERVICE TOTAL

FISCAL TAXABLE FUND FUND TAX

YEAR VALUE (1) RATE RATE RATE

2023 $ 9,064,721,083 $ 0.29500 $ 0.06500 $ 0.36000

2022 $ 8,220,731,143 $ 0.32500 $ 0.06500 $ 0.39000

2021 $ 7,768,644,007 $ 0.33000 $ 0.07500 $ 0.40500

2020 $ 7,769,729,082 $ 0.33000 $ 0.08000 $ 0.41000

2019 $ 7,286,898,962 $ 0.35700 $ 0.09000 $ 0.44700

2018 $ 6,618,228,023 $ 0.36200 $ 0.10000 $ 0.46200

2017 $ 6,368,901,046 $ 0.36200 $ 0.10000 $ 0.46200

2016 $ 5,785,322,918 $ 0.36200 $ 0.10000 $ 0.46200

2015 $ 5,680,109,441 $ 0.34200 $ 0.12000 $ 0.46200

2014 $ 5,494,514,119 $ 0.34200 $ 0.12000 $ 0.46200

2013 $ 5,331,182,997 $ 0.34200 $ 0.12000 $ 0.46200

2012 $ 5,290,518,261 $ 0.33200 $ 0.13000 $ 0.46200

(1) Excluding TIF values

474 FY 2023 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM