Page 252 - Southlake FY23 Budget

P. 252

DEBT SERVICE FUnDS ExPEnDITURES

The Relationship Between Property Taxpayers and Debt Repayment

At 36 cents for every one hundred dollars of valuation, the City of Southlake’s property tax rate supports basic city

services such as public safety, street maintenance, library and community services. It also helps pay off the debt that’s

been incurred for city infrastructure such as new roadway construction and expansion.

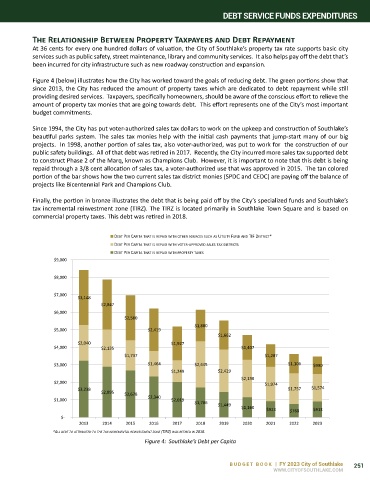

Figure 4 (below) illustrates how the City has worked toward the goals of reducing debt. The green portions show that

since 2013, the City has reduced the amount of property taxes which are dedicated to debt repayment while still

providing desired services. Taxpayers, specifically homeowners, should be aware of the conscious effort to relieve the

amount of property tax monies that are going towards debt. This effort represents one of the City’s most important

budget commitments.

Since 1994, the City has put voter-authorized sales tax dollars to work on the upkeep and construction of Southlake’s

beautiful parks system. The sales tax monies help with the initial cash payments that jump-start many of our big

projects. In 1998, another portion of sales tax, also voter-authorized, was put to work for the construction of our

public safety buildings. All of that debt was retired in 2017. Recently, the City incurred more sales tax supported debt

to construct Phase 2 of the Marq, known as Champions Club. However, it is important to note that this debt is being

repaid through a 3/8 cent allocation of sales tax, a voter-authorized use that was approved in 2015. The tan colored

portion of the bar shows how the two current sales tax district monies (SPDC and CEDC) are paying off the balance of

projects like Bicentennial Park and Champions Club.

Finally, the portion in bronze illustrates the debt that is being paid off by the City’s specialized funds and Southlake’s

tax incremental reinvestment zone (TIRZ). The TIRZ is located primarily in Southlake Town Square and is based on

commercial property taxes. This debt was retired in 2018.

DEBT PER CAPITA THAT IS REPAID WITH OTHER SOURCES SUCH AS UTILITY FUND AND TIF DISTRICT*

DEBT PER CAPITA THAT IS REPAID WITH VOTER-APPROVED SALES TAX DISTRICTS

DEBT PER CAPITA THAT IS REPAID WITH PROPERTY TAXES

$9,000

$8,000

$7,000

$3,148

$2,847

$6,000

$2,560

$1,800

$5,000 $2,419

$1,662

$2,040 $1,927

$4,000 $2,135 $1,407

$1,737 $1,287

$3,000 $1,464 $2,645 $1,106 $990

$1,249 $2,429

$2,138

$2,000 $1,974

$3,238 $1,757 $1,574

$2,895 $2,678

$1,000 $2,340 $2,019

$1,706 $1,449

$1,160 $923 $768 $913

$-

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

*ALL DEBT TO ATTRIBUTED TO THE TAX INCREMENTAL REINVESTMENT ZONE (TIRZ) WAS RETIRED IN 2018.

Figure 4: Southlake’s Debt per Capita

BUDGET BOOK | FY 2023 City of Southlake 251

WWW.CITYOFSOUTHLAKE.COM