Page 251 - Southlake FY23 Budget

P. 251

DEBT SERVICE FUnDS ExPEnDITURES

Debt Management

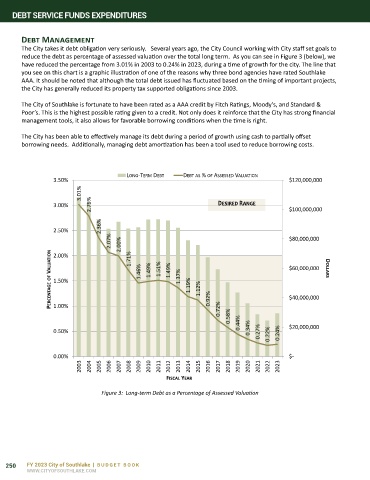

The City takes it debt obligation very seriously. Several years ago, the City Council working with City staff set goals to

reduce the debt as percentage of assessed valuation over the total long term. As you can see in Figure 3 (below), we

have reduced the percentage from 3.01% in 2003 to 0.24% in 2023, during a time of growth for the city. The line that

you see on this chart is a graphic illustration of one of the reasons why three bond agencies have rated Southlake

AAA. It should be noted that although the total debt issued has fluctuated based on the timing of important projects,

the City has generally reduced its property tax supported obligations since 2003.

The City of Southlake is fortunate to have been rated as a AAA credit by Fitch Ratings, Moody’s, and Standard &

Poor’s. This is the highest possible rating given to a credit. Not only does it reinforce that the City has strong financial

management tools, it also allows for favorable borrowing conditions when the time is right.

The City has been able to effectively manage its debt during a period of growth using cash to partially offset

borrowing needs. Additionally, managing debt amortization has been a tool used to reduce borrowing costs.

LONG-TERM DEBT DEBT AS % OF ASSESSED VALUATION

3.50% $120,000,000

3.01%

3.00% 2.79% Desired Range $100,000,000

2.36%

2.50%

2.07% 2.00% $80,000,000

VALUATION 2.00% 1.71% 1.49% 1.51% $60,000,000 DOLLARS

OF 1.50% 1.46% 1.49% 1.37% 1.19%

PERCENTAGE 1.00% 1.12% 0.92% 0.72% $40,000,000

0.50% 0.58% 0.44% 0.34% 0.27% 0.22% 0.24% $20,000,000

0.00% $-

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

FISCAL YEAR

Figure 3: Long-term Debt as a Percentage of Assessed Valuation

250 FY 2023 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM