Page 68 - GFOA Draft 2

P. 68

CITY OF SAGINAW

GENERAL FUND OVERVIEW OF REVENUES

2022-2023

The City of Saginaw's General Fund accounts for resources that are traditionally associated with governmental activity and

which are not required to be accounted for in another fund. These resources are used for expenditures of the General

Administrative O ce, Municipal Court, Fire, Police, Public Services, Parks, Community Services, Library, Inspections/Code

Enforcement, Animal Services, Fleet Maintenance, Information Technology, Economic Development, Emergency

Management, and Communications of the General Fund.

Below is an overview of the General Fund Revenues. The City's revenues are reviewed individually and are based on trend

analysis.

CURRENT PROPERTY TAXES:

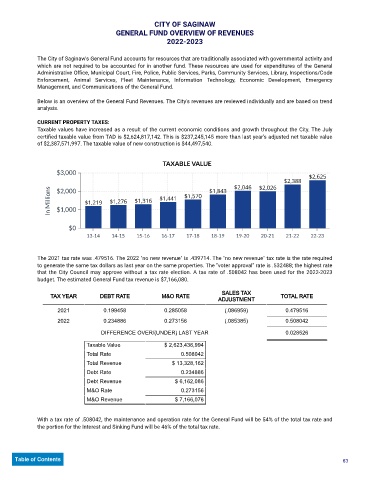

Taxable values have increased as a result of the current economic conditions and growth throughout the City. The July

certi ed taxable value from TAD is $2,624,817,142. This is $237,245,145 more than last year's adjusted net taxable value

of $2,387,571,997. The taxable value of new construction is $44,497,540.

TAXABLE VALUE

$3,000

$2,625

$2,388

In Millions $1,000 $1,219 $1,276 $1,316 $1,441 $1,570 $1,843

$2,000

$2,046

$2,026

$0

13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22 22-23

The 2021 tax rate was .479516. The 2022 "no new revenue" is .439714. The "no new revenue" tax rate is the rate required

to generate the same tax dollars as last year on the same properties. The "voter approval" rate is .532488; the highest rate

that the City Council may approve without a tax rate election. A tax rate of .508042 has been used for the 2022-2023

budget. The estimated General Fund tax revenue is $7,166,080.

SALES TAX

TAX YEAR DEBT RATE M&O RATE TOTAL RATE

ADJUSTMENT

2021 0.199458 0.285058 (.086959) 0.479516

2022 0.234886 0.273156 (.085385) 0.508042

DIFFERENCE OVER/(UNDER) LAST YEAR 0.028526

Taxable Value $ 2,623,436,994

Total Rate 0.508042

Total Revenue $ 13,328,162

Debt Rate 0.234886

Debt Revenue $ 6,162,086

M&O Rate 0.273156

M&O Revenue $ 7,166,076

With a tax rate of .508042, the maintenance and operation rate for the General Fund will be 54% of the total tax rate and

the portion for the Interest and Sinking Fund will be 46% of the total tax rate.

Table of Contents 63