Page 67 - GFOA Draft 2

P. 67

CITY OF SAGINAW

BUDGET DETAIL

2022-2023

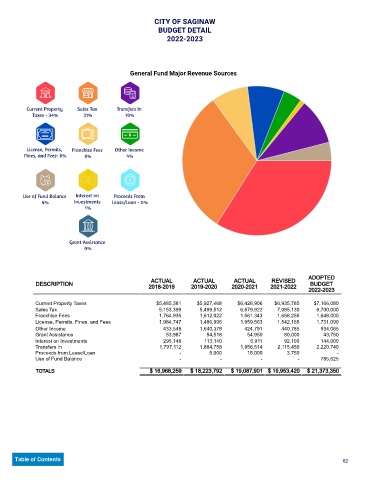

General Fund Major Revenue Sources

Current Property Sales Tax Transfers In

Taxes - 34% 31% 10%

License, Permits, Franchise Fees Other Income

Fines, and Fees- 8% 8% 4%

Use of Fund Balance Interest on Proceeds From

4% Investments Lease/Loan - 0%

1%

Grant Assistance

0%

ADOPTED

ACTUAL ACTUAL ACTUAL REVISED

DESCRIPTION 2018-2019 2019-2020 2020-2021 2021-2022 BUDGET

2022-2023

Current Property Taxes $5,485,381 $5,927,468 $6,428,906 $6,935,785 $7,166,080

Sales Tax 5,153,399 5,499,512 6,679,922 7,085,130 6,700,000

Franchise Fees 1,764,936 1,612,022 1,561,343 1,658,255 1,648,000

License, Permits, Fines, and Fees 1,984,747 1,486,996 1,959,563 1,542,165 1,731,090

Other Income 433,548 1,640,378 424,791 440,785 934,065

Grant Assistance 53,987 54,518 54,950 80,000 43,750

Interest on Investments 295,148 113,140 6,911 92,100 144,000

Transfers In 1,797,112 1,884,758 1,956,514 2,115,450 2,220,740

Proceeds from Lease/Loan - 5,000 15,000 3,750 -

Use of Fund Balance - - - - 785,625

TOTALS $ 16,968,259 $ 18,223,792 $ 19,087,901 $ 19,953,420 $ 21,373,350

Table of Contents 62