Page 53 - GFOA Draft 2

P. 53

CITY OF SAGINAW

5-YEAR FUND SUMMARY

Explanation of Variances

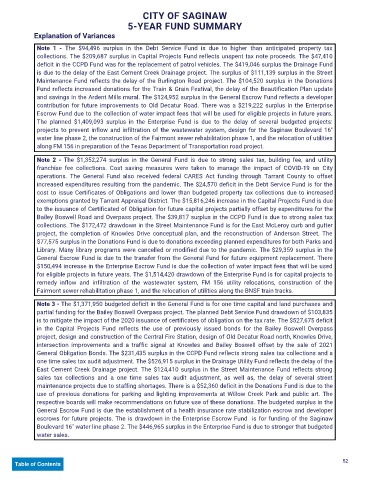

Note 1 - The $94,496 surplus in the Debt Service Fund is due to higher than anticipated property tax

collections. The $209,687 surplus in Capital Projects Fund reflects unspent tax note proceeds. The $47,410

deficit in the CCPD Fund was for the replacement of patrol vehicles. The $419,046 surplus the Drainage Fund

is due to the delay of the East Cement Creek Drainage project. The surplus of $111,139 surplus in the Street

Maintenance Fund reflects the delay of the Burlington Road project. The $104,520 surplus in the Donations

Fund reflects increased donations for the Train & Grain Festival, the delay of the Beautification Plan update

and savings in the Ardent Mills mural. The $124,952 surplus in the General Escrow Fund reflects a developer

contribution for future improvements to Old Decatur Road. There was a $219,222 surplus in the Enterprise

Escrow Fund due to the collection of water impact fees that will be used for eligible projects in future years.

The planned $1,409,093 surplus in the Enterprise Fund is due to the delay of several budgeted projects:

projects to prevent inflow and infiltration of the wastewater system, design for the Saginaw Boulevard 16"

water line phase 2, the construction of the Fairmont sewer rehabilitation phase 1, and the relocation of utilities

along FM 156 in preparation of the Texas Department of Transportation road project.

Note 2 - The $1,352,274 surplus in the General Fund is due to strong sales tax, building fee, and utility

franchise fee collections. Cost saving measures were taken to manage the impact of COVID-19 on City

operations. The General Fund also received federal CARES Act funding through Tarrant County to offset

increased expenditures resulting from the pandemic. The $24,570 deficit in the Debt Service Fund is for the

cost to issue Certificates of Obligations and lower than budgeted property tax collections due to increased

exemptions granted by Tarrant Appraisal District. The $15,816,246 increase in the Capital Projects Fund is due

to the issuance of Certificated of Obligation for future capital projects partially offset by expenditures for the

Bailey Boswell Road and Overpass project. The $39,817 surplus in the CCPD Fund is due to strong sales tax

collections. The $172,472 drawdown in the Street Maintenance Fund is for the East McLeroy curb and gutter

project, the completion of Knowles Drive conceptual plan, and the reconstruction of Anderson Street. The

$77,575 surplus in the Donations Fund is due to donations exceeding planned expenditures for both Parks and

Library. Many library programs were cancelled or modified due to the pandemic. The $29,359 surplus in the

General Escrow Fund is due to the transfer from the General Fund for future equipment replacement. There

$150,494 increase in the Enterprise Escrow Fund is due the collection of water impact fees that will be used

for eligible projects in future years. The $1,514,420 drawdown of the Enterprise Fund is for capital projects to

remedy inflow and infiltration of the wastewater system, FM 156 utility relocations, construction of the

Fairmont sewer rehabilitation phase 1, and the relocation of utilities along the BNSF train tracks.

Note 3 - The $1,371,950 budgeted deficit in the General Fund is for one time capital and land purchases and

partial funding for the Bailey Boswell Overpass project. The planned Debt Service Fund drawdown of $103,835

is to mitigate the impact of the 2020 issuance of certificates of obligation on the tax rate. The $527,675 deficit

in the Capital Projects Fund reflects the use of previously issued bonds for the Bailey Boswell Overpass

project, design and construction of the Central Fire Station, design of Old Decatur Road north, Knowles Drive,

intersection improvements and a traffic signal at Knowles and Bailey Boswell offset by the sale of 2021

General Obligation Bonds. The $231,435 surplus in the CCPD Fund reflects strong sales tax collections and a

one time sales tax audit adjustment. The $526,915 surplus in the Drainage Utility Fund reflects the delay of the

East Cement Creek Drainage project. The $124,410 surplus in the Street Maintenance Fund reflects strong

sales tax collections and a one time sales tax audit adjustment, as well as, the delay of several street

maintenance projects due to staffing shortages. There is a $52,360 deficit in the Donations Fund is due to the

use of previous donations for parking and lighting improvements at Willow Creek Park and public art. The

respective boards will make recommendations on future use of these donations. The budgeted surplus in the

General Escrow Fund is due the establishment of a health insurance rate stabilization escrow and developer

escrows for future projects. The is drawdown in the Enterprise Escrow Fund is for funding of the Saginaw

Boulevard 16" water line phase 2. The $446,965 surplus in the Enterprise Fund is due to stronger that budgeted

water sales.

52

Table of Contents