Page 36 - GFOA Draft 2

P. 36

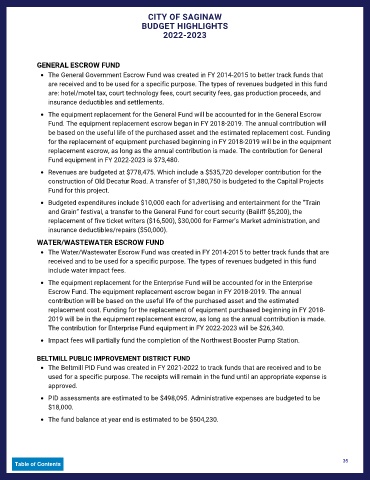

CITY OF SAGINAW

BUDGET HIGHLIGHTS

2022-2023

GENERAL ESCROW FUND

The General Government Escrow Fund was created in FY 2014-2015 to better track funds that

are received and to be used for a specific purpose. The types of revenues budgeted in this fund

are: hotel/motel tax, court technology fees, court security fees, gas production proceeds, and

insurance deductibles and settlements.

The equipment replacement for the General Fund will be accounted for in the General Escrow

Fund. The equipment replacement escrow began in FY 2018-2019. The annual contribution will

be based on the useful life of the purchased asset and the estimated replacement cost. Funding

for the replacement of equipment purchased beginning in FY 2018-2019 will be in the equipment

replacement escrow, as long as the annual contribution is made. The contribution for General

Fund equipment in FY 2022-2023 is $73,480.

Revenues are budgeted at $778,475. Which include a $535,720 developer contribution for the

construction of Old Decatur Road. A transfer of $1,380,750 is budgeted to the Capital Projects

Fund for this project.

Budgeted expenditures include $10,000 each for advertising and entertainment for the “Train

and Grain” festival, a transfer to the General Fund for court security (Bailiff $5,200), the

replacement of five ticket writers ($16,500), $30,000 for Farmer’s Market administration, and

insurance deductibles/repairs ($50,000).

WATER/WASTEWATER ESCROW FUND

The Water/Wastewater Escrow Fund was created in FY 2014-2015 to better track funds that are

received and to be used for a specific purpose. The types of revenues budgeted in this fund

include water impact fees.

The equipment replacement for the Enterprise Fund will be accounted for in the Enterprise

Escrow Fund. The equipment replacement escrow began in FY 2018-2019. The annual

contribution will be based on the useful life of the purchased asset and the estimated

replacement cost. Funding for the replacement of equipment purchased beginning in FY 2018-

2019 will be in the equipment replacement escrow, as long as the annual contribution is made.

The contribution for Enterprise Fund equipment in FY 2022-2023 will be $26,340.

Impact fees will partially fund the completion of the Northwest Booster Pump Station.

BELTMILL PUBLIC IMPROVEMENT DISTRICT FUND

The Beltmill PID Fund was created in FY 2021-2022 to track funds that are received and to be

used for a specific purpose. The receipts will remain in the fund until an appropriate expense is

approved.

PID assessments are estimated to be $498,095. Administrative expenses are budgeted to be

$18,000.

The fund balance at year end is estimated to be $504,230.

35

Table of Contents