Page 41 - GFOA Draft 2

P. 41

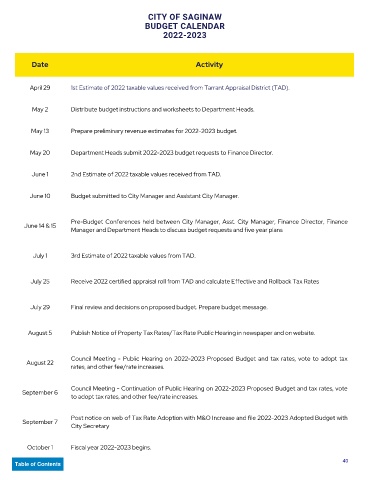

CITY OF SAGINAW

BUDGET CALENDAR

2022-2023

Date Activity

April 29 1st Estimate of 2022 taxable values received from Tarrant Appraisal District (TAD).

May 2 Distribute budget instructions and worksheets to Department Heads.

May 13 Prepare preliminary revenue estimates for 2022-2023 budget.

May 20 Department Heads submit 2022-2023 budget requests to Finance Director.

June 1 2nd Estimate of 2022 taxable values received from TAD.

June 10 Budget submitted to City Manager and Assistant City Manager.

Pre-Budget Conferences held between City Manager, Asst. City Manager, Finance Director, Finance

June 14 & 15

Manager and Department Heads to discuss budget requests and five year plans

July 1 3rd Estimate of 2022 taxable values from TAD.

July 25 Receive 2022 certified appraisal roll from TAD and calculate Effective and Rollback Tax Rates

July 29 Final review and decisions on proposed budget. Prepare budget message.

August 5 Publish Notice of Property Tax Rates/Tax Rate Public Hearing in newspaper and on website.

Council Meeting - Public Hearing on 2022-2023 Proposed Budget and tax rates, vote to adopt tax

August 22

rates, and other fee/rate increases.

Council Meeting - Continuation of Public Hearing on 2022-2023 Proposed Budget and tax rates, vote

September 6

to adopt tax rates, and other fee/rate increases.

Post notice on web of Tax Rate Adoption with M&O Increase and file 2022-2023 Adopted Budget with

September 7

City Secretary

October 1 Fiscal year 2022-2023 begins.

40

Table of Contents