Page 34 - GFOA Draft 2

P. 34

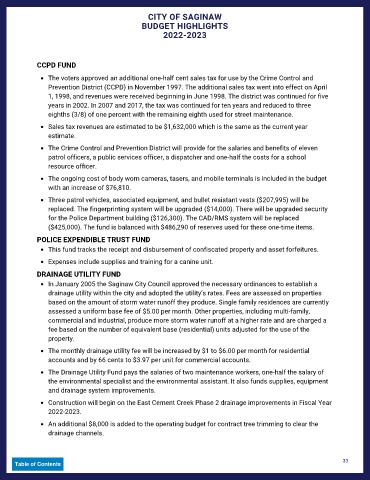

CITY OF SAGINAW

BUDGET HIGHLIGHTS

2022-2023

CCPD FUND

The voters approved an additional one-half cent sales tax for use by the Crime Control and

Prevention District (CCPD) in November 1997. The additional sales tax went into effect on April

1, 1998, and revenues were received beginning in June 1998. The district was continued for five

years in 2002. In 2007 and 2017, the tax was continued for ten years and reduced to three

eighths (3/8) of one percent with the remaining eighth used for street maintenance.

Sales tax revenues are estimated to be $1,632,000 which is the same as the current year

estimate.

The Crime Control and Prevention District will provide for the salaries and benefits of eleven

patrol officers, a public services officer, a dispatcher and one-half the costs for a school

resource officer.

The ongoing cost of body worn cameras, tasers, and mobile terminals is included in the budget

with an increase of $76,810.

Three patrol vehicles, associated equipment, and bullet resistant vests ($207,995) will be

replaced. The fingerprinting system will be upgraded ($14,000). There will be upgraded security

for the Police Department building ($126,300). The CAD/RMS system will be replaced

($425,000). The fund is balanced with $486,290 of reserves used for these one-time items.

POLICE EXPENDIBLE TRUST FUND

This fund tracks the receipt and disbursement of confiscated property and asset forfeitures.

Expenses include supplies and training for a canine unit.

DRAINAGE UTILITY FUND

In January 2005 the Saginaw City Council approved the necessary ordinances to establish a

drainage utility within the city and adopted the utility’s rates. Fees are assessed on properties

based on the amount of storm water runoff they produce. Single family residences are currently

assessed a uniform base fee of $5.00 per month. Other properties, including multi-family,

commercial and industrial, produce more storm water runoff at a higher rate and are charged a

fee based on the number of equivalent base (residential) units adjusted for the use of the

property.

The monthly drainage utility fee will be increased by $1 to $6.00 per month for residential

accounts and by 66 cents to $3.97 per unit for commercial accounts.

The Drainage Utility Fund pays the salaries of two maintenance workers, one-half the salary of

the environmental specialist and the environmental assistant. It also funds supplies, equipment

and drainage system improvements.

Construction will begin on the East Cement Creek Phase 2 drainage improvements in Fiscal Year

2022-2023.

An additional $8,000 is added to the operating budget for contract tree trimming to clear the

drainage channels.

33

Table of Contents