Page 50 - CityofHaltomFY23Budget

P. 50

CITY OF HALTOM CITY ANNUAL BUDGET, FY2023 Budget overview

SALES TAX

The City imposes a local option sales tax of 2% on all retail sales, leases, and rentals of most

goods, as well as taxable services. The sales tax allocations are: 1.375% for general purposes and

is recorded in the General Fund, 0.25% is for crime control and prevention and is recorded in the

Crime Control and Prevention District Fund, and the rest of the 0.375% is for street improvements

and is recorded in the Street Reconstruction Fund.

Outlook

Sales tax revenues for FY2023 were budgeted at around 13.2% increase in General Fund. Although

our City continues to budget conservatively there is still double-digit increases due to a strong local

economy, and new economic development. We expect sales tax to continue to increase with the

completion of two large warehouse facilities and new tenants occupying the new spaces.

Major Influence

Factors affecting sales tax revenues include population, new economic growth, retail sales, strong

local economy, and consumer price index.

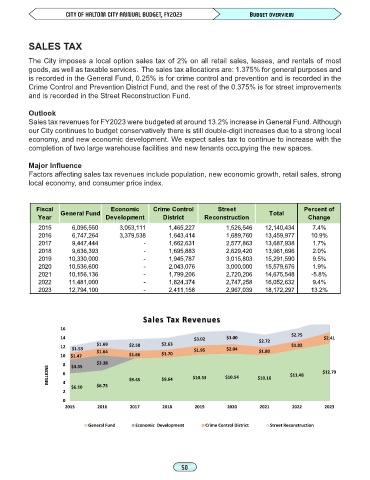

Fiscal General Fund Economic Crime Control Street Total Percent of

Year Development District Reconstruction Change

2015 6,095,550 3,053,111 1,465,227 1,526,546 12,140,434 7.4%

2016 6,747,264 3,379,538 1,643,414 1,689,760 13,459,977 10.9%

2017 9,447,444 - 1,662,631 2,577,863 13,687,938 1.7%

2018 9,636,393 - 1,695,883 2,629,420 13,961,696 2.0%

2019 10,330,000 - 1,945,787 3,015,803 15,291,590 9.5%

2020 10,536,600 - 2,043,076 3,000,000 15,579,676 1.9%

2021 10,156,136 - 1,799,206 2,720,206 14,675,548 -5.8%

2022 11,481,000 - 1,824,374 2,747,258 16,052,632 9.4%

2023 12,794,100 - 2,411,158 2,967,039 18,172,297 13.2%

Sales Tax Revenues

16

14 $3.02 $3.00 $2.72 $2.75 $2.41

12 $1.53 $1.69 $2.58 $2.63 $1.95 $2.04 $1.82

10 $1.47 $1.64 $1.66 $1.70 $1.80

8 $3.05 $3.38

MILLIONS 6 4 $9.45 $9.64 $10.33 $10.54 $10.16 $11.48 $12.79

2 $6.10 $6.75

0

2015 2016 2017 2018 2019 2020 2021 2022 2023

General Fund Economic Development Crime Control District Street Reconstruction