Page 48 - CityofHaltomFY23Budget

P. 48

CITY OF HALTOM CITY ANNUAL BUDGET, FY2023 Budget overview

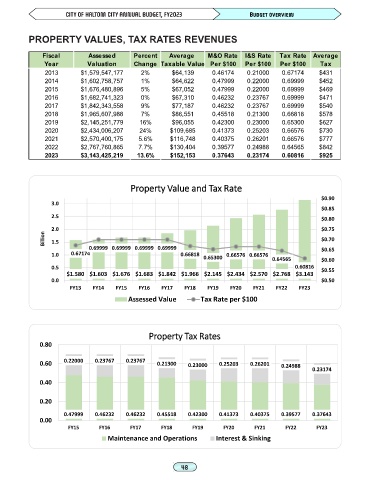

PROPERTY VALUES, TAX RATES REVENUES

Fiscal Assessed Percent Average M&O Rate I&S Rate Tax Rate Average

Year Valuation Change Taxable Value Per $100 Per $100 Per $100 Tax

2013 $1,579,547,177 2% $64,139 0.46174 0.21000 0.67174 $431

2014 $1,602,758,757 1% $64,622 0.47999 0.22000 0.69999 $452

2015 $1,676,480,896 5% $67,052 0.47999 0.22000 0.69999 $469

2016 $1,682,741,323 0% $67,310 0.46232 0.23767 0.69999 $471

2017 $1,842,343,558 9% $77,187 0.46232 0.23767 0.69999 $540

2018 $1,965,607,988 7% $86,551 0.45518 0.21300 0.66818 $578

2019 $2,145,251,779 16% $96,055 0.42300 0.23000 0.65300 $627

2020 $2,434,006,207 24% $109,685 0.41373 0.25203 0.66576 $730

2021 $2,570,400,175 5.6% $116,748 0.40375 0.26201 0.66576 $777

2022 $2,767,760,865 7.7% $130,404 0.39577 0.24988 0.64565 $842

2023 $3,143,425,219 13.6% $152,153 0.37643 0.23174 0.60816 $925

Property Value and Tax Rate

$0.90

3.0

$0.85

2.5 $0.80

2.0 $0.75

Billion 1.5 $0.70

1.0 0.67174 0.69999 0.69999 0.69999 0.69999 0.66818 0.65300 0.66576 0.66576 0.64565 $0.65

$0.60

0.5 0.60816 $0.55

$1.580 $1.603 $1.676 $1.683 $1.842 $1.966 $2.145 $2.434 $2.570 $2.768 $3.143

0.0 $0.50

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

Assessed Value Tax Rate per $100

Property Tax Rates

0.80

0.60 0.22000 0.23767 0.23767 0.21300 0.23000 0.25203 0.26201 0.24988

0.23174

0.40

0.20

0.47999 0.46232 0.46232 0.45518 0.42300 0.41373 0.40375 0.39577 0.37643

0.00

FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

Maintenance and Operations Interest & Sinking