Page 165 - CityofHaltomFY23Budget

P. 165

CITY OF HALTOM CITY ANNUAL BUDGET, FY2023 Supplemental Information

Debt capacity has been structured in previous years so it can be accomplished without an increase

in the I&S portion of the property tax. Fortunately, the new commercial and residential growth has

been an effective way to expand the overall values to broaden the tax base and lessen the burden

on citizens. Because of the increases in values, the City was able to lower its property tax rate to

its lowest in over thirteen years. The property tax rate was lowered almost four cents from the

previous year and almost six cents total in the last two budget years. Building the tax base is the

most effective way of accomplishing this. Not only do we strive to build the tax base, but we also

want to build our reserve balances. Our multi-year financial plan reflects these goals.

Building the reserve will only benefit the city in future years by preparing city staff to continue

to offer quality services and maintain staffing during economic down-turns. As unexpected as

the Covid-19 pandemic that caused a shut-down of many non-essential businesses during the

2020 fiscal year, having a healthy reserve balance will help weather a fiscal storm. The city has

effectively continued to build the fund balance in each fund to prepare for any future downturn in

the economy. Expenses will always be adjusted as necessary in relation to revenue forecasts.

Healthy fund balances will help fund all necessary expenses even if revenues decline.

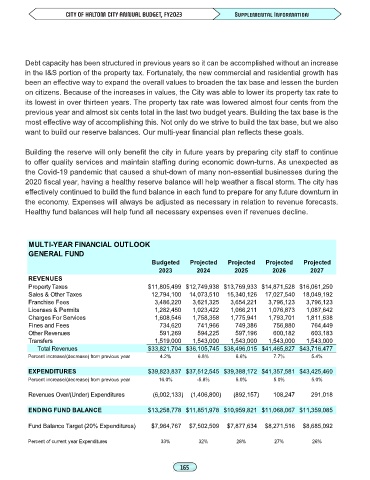

MULTI-YEAR FINANCIAL OUTLOOK

GENERAL FUND

Budgeted Projected Projected Projected Projected

2023 2024 2025 2026 2027

REVENUES

Property Taxes $11,805,499 $12,749,938 $13,769,933 $14,871,528 $16,061,250

Sales & Other Taxes 12,794,100 14,073,510 15,340,126 17,027,540 18,049,192

Franchise Fees 3,486,220 3,621,325 3,654,221 3,796,123 3,796,123

Licenses & Permits 1,282,450 1,023,422 1,066,211 1,076,873 1,087,642

Charges For Services 1,608,546 1,758,358 1,775,941 1,793,701 1,811,638

Fines and Fees 734,620 741,966 749,386 756,880 764,449

Other Revenues 591,269 594,225 597,196 600,182 603,183

Transfers 1,519,000 1,543,000 1,543,000 1,543,000 1,543,000

Total Revenues $33,821,704 $36,105,745 $38,496,015 $41,465,827 $43,716,477

Percent increase/(decrease) from previous year 4.2% 6.8% 6.6% 7.7% 5.4%

EXPENDITURES $39,823,837 $37,512,545 $39,388,172 $41,357,581 $43,425,460

Percent increase/(decrease) from previous year 16.0% -5.8% 5.0% 5.0% 5.0%

Revenues Over/(Under) Expenditures (6,002,133) (1,406,800) (892,157) 108,247 291,018

ENDING FUND BALANCE $13,258,778 $11,851,978 $10,959,821 $11,068,067 $11,359,085

Fund Balance Target (20% Expenditures) $7,964,767 $7,502,509 $7,877,634 $8,271,516 $8,685,092

Percent of current year Expenditures 33% 32% 28% 27% 26%