Page 528 - Bedford-FY22-23 Budget

P. 528

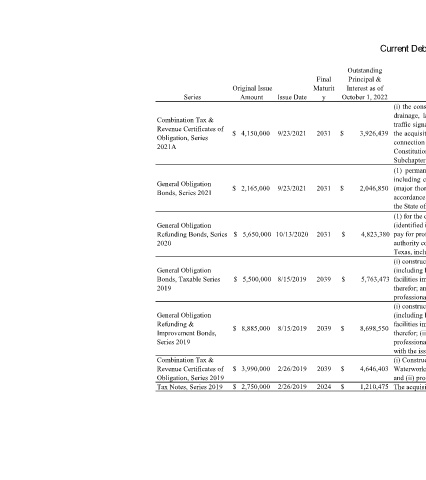

Current Debt Issuances

Outstanding

Final Principal &

Original Issue Maturit Interest as of Self-

Series Amount Issue Date y October 1, 2022 Purpose of Debt Supporting?

(i) the construction of public works, to wit: constructing and improving streets, including

drainage, landscaping, streetscaping, retaining walls, curbs, gutters, sidewalks, signage,

Combination Tax & traffic signalization, street noise abatement, utility system relocation incidental thereto and

Revenue Certificates of $ 4,150,000 9/23/2021 2031 $ 3,926,439 the acquisition of land and rights-of-way therefor and (ii) professional services rendered in Yes

Obligation, Series connection therewith, pursuant to authority conferred by and in conformity with the

2021A

Constitution and laws of the State of Texas, including Texas Local Government Code,

Subchapter C of Chapter 271, as amended.

(1) permanent public improvements and public purposes, to wit: street improvements,

including curbs, gutters, sidewalks, drainage and utility line relocations incidental thereto

General Obligation $ 2,165,000 9/23/2021 2031 $ 2,046,850 (major thoroughfares and traffic signalization) and (2) to pay the costs of issuance, all in Yes

Bonds, Series 2021

accordance with authority conferred by and in conformity with the Constitution and laws of

the State of Texas, including Chapter 1331 of the Texas Government Code, as amended.

(1) for the discharge and final payment of certain outstanding obligations of the City

General Obligation (identified in the preamble hereof and referred to as the “Refunded Obligations”) and (2) to

Refunding Bonds, Series $ 5,650,000 10/13/2020 2031 $ 4,823,380 pay for professional services rendered in relation thereto, all in accordance with the Partially

2020 authority conferred by and in conformity with the Constitution and laws of the State of

Texas, including Chapter 1207 of the Texas Government Code, as amended.

(i) constructing, improving, renovating, and equipping park and recreation facilities

General Obligation (including ball field improvements, aquatic center improvements, multi-purpose event

Bonds, Taxable Series $ 5,500,000 8/15/2019 2039 $ 5,763,473 facilities improvements and other related improvements) including the acquistion of land No

2019 therefor; and (ii) pay for professional services of attorneys, financial advisors and other

professionals in connection with the issuance of the Taxable Bonds.

(i) constructing, improving, renovating, and equipping park and recreation facilities

General Obligation (including ball field improvements, aquatic center improvements, multi-purpose event

Refunding & $ 8,885,000 8/15/2019 2039 $ 8,698,550 facilities improvements and other related improvements) including the acquistion of land Partially

Improvement Bonds, therefor; (ii) refunding the Refunded Obligations for debt service savings; and (iii) pay for

Series 2019 professional services of attorneys, financial advisors and other professionals in connection

with the issuance of the Bonds.

Combination Tax & (i) Construction of public works, to wit: improving and extending the City's combined

Revenue Certificates of $ 3,990,000 2/26/2019 2039 $ 4,646,403 Waterworks and Sewer System, including the acquisition of land and rights-of-way therefor Yes

Obligation, Series 2019 and (ii) professional services rendered in relation to such projects

Tax Notes, Series 2019 $ 2,750,000 2/26/2019 2024 $ 1,210,475 The acquisition and installation of public safety vehicles, equipment and software No