Page 73 - CITY OF AZLE, TEXAS

P. 73

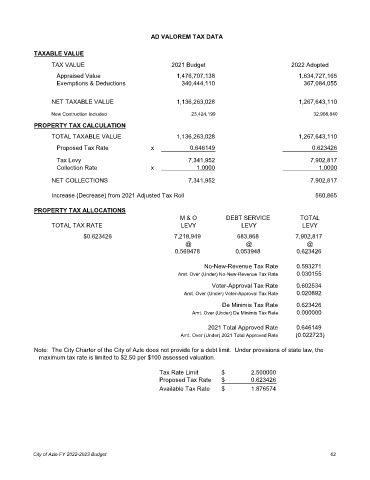

AD VALOREM TAX DATA

TAXABLE VALUE

TAX VALUE 2021 Budget 2022 Adopted

Appraised Value 1,476,707,138 1,634,727,165

Exemptions & Deductions 340,444,110 367,084,055

NET TAXABLE VALUE 1,136,263,028 1,267,643,110

New Contruction Included 23,424,199 32,908,840

PROPERTY TAX CALCULATION

TOTAL TAXABLE VALUE 1,136,263,028 1,267,643,110

Proposed Tax Rate x 0.646149 0.623426

Tax Levy 7,341,952 7,902,817

Collection Rate x 1.0000 1.0000

NET COLLECTIONS 7,341,952 7,902,817

Increase (Decrease) from 2021 Adjusted Tax Roll 560,865

PROPERTY TAX ALLOCATIONS

M & O DEBT SERVICE TOTAL

TOTAL TAX RATE LEVY LEVY LEVY

$0.623426 7,218,949 683,868 7,902,817

@ @ @

0.569478 0.053948 0.623426

No-New-Revenue Tax Rate 0.593271

Amt. Over (Under) No-New-Revenue Tax Rate 0.030155

Voter-Approval Tax Rate 0.602534

Amt. Over (Under) Voter-Approval Tax Rate 0.020892

De Minimis Tax Rate 0.623426

Amt. Over (Under) De Minimis Tax Rate 0.000000

2021 Total Approved Rate 0.646149

Amt. Over (Under) 2021 Total Approved Rate (0.022723)

Note: The City Charter of the City of Azle does not provide for a debt limit. Under provisions of state law, the

maximum tax rate is limited to $2.50 per $100 assessed valuation.

Tax Rate Limit $ 2.500000

Proposed Tax Rate $ 0.623426

Available Tax Rate $ 1.876574

City of Azle FY 2022-2023 Budget 62