Page 514 - Southlake FY22 Budget

P. 514

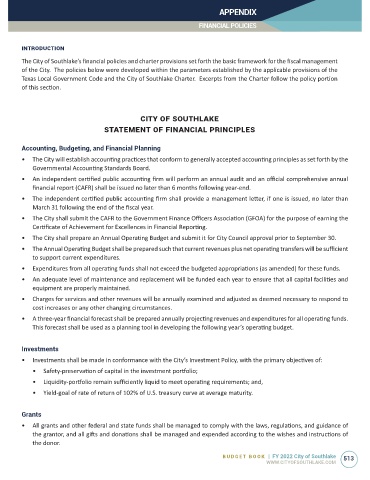

APPEnDIX

FInAnCIAL POLICIES

inTrOduCTiOn

The City of Southlake’s financial policies and charter provisions set forth the basic framework for the fiscal management

of the City. The policies below were developed within the parameters established by the applicable provisions of the

Texas Local Government Code and the City of Southlake Charter. Excerpts from the Charter follow the policy portion

of this section.

CiTy Of sOuThlake

sTaTemenT Of finanCial PrinCiPles

Accounting, Budgeting, and Financial Planning

• The City will establish accounting practices that conform to generally accepted accounting principles as set forth by the

Governmental Accounting Standards Board.

• An independent certified public accounting firm will perform an annual audit and an official comprehensive annual

financial report (CAFR) shall be issued no later than 6 months following year-end.

• The independent certified public accounting firm shall provide a management letter, if one is issued, no later than

March 31 following the end of the fiscal year.

• The City shall submit the CAFR to the Government Finance Officers Association (GFOA) for the purpose of earning the

Certificate of Achievement for Excellences in Financial Reporting.

• The City shall prepare an Annual Operating Budget and submit it for City Council approval prior to September 30.

• The Annual Operating Budget shall be prepared such that current revenues plus net operating transfers will be sufficient

to support current expenditures.

• Expenditures from all operating funds shall not exceed the budgeted appropriations (as amended) for these funds.

• An adequate level of maintenance and replacement will be funded each year to ensure that all capital facilities and

equipment are properly maintained.

• Charges for services and other revenues will be annually examined and adjusted as deemed necessary to respond to

cost increases or any other changing circumstances.

• A three-year financial forecast shall be prepared annually projecting revenues and expenditures for all operating funds.

This forecast shall be used as a planning tool in developing the following year’s operating budget.

Investments

• Investments shall be made in conformance with the City’s Investment Policy, with the primary objectives of:

• Safety-preservation of capital in the investment portfolio;

• Liquidity-portfolio remain sufficiently liquid to meet operating requirements; and,

• Yield-goal of rate of return of 102% of U.S. treasury curve at average maturity.

Grants

• All grants and other federal and state funds shall be managed to comply with the laws, regulations, and guidance of

the grantor, and all gifts and donations shall be managed and expended according to the wishes and instructions of

the donor.

BUDGET BOOK | FY 2022 City of Southlake 513

WWW.CITYOFSOUTHLAKE.COM