Page 65 - Saginaw FY22 Adopted Annual Budget

P. 65

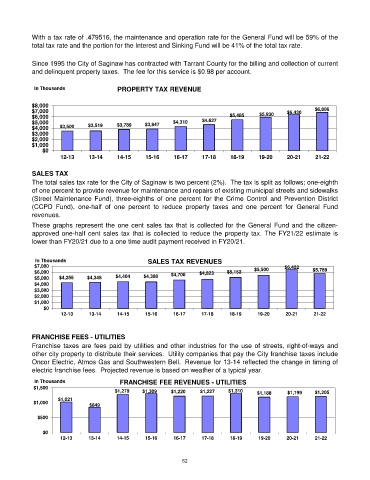

With a tax rate of .479516, the maintenance and operation rate for the General Fund will be 59% of the

total tax rate and the portion for the Interest and Sinking Fund will be 41% of the total tax rate.

Since 1995 the City of Saginaw has contracted with Tarrant County for the billing and collection of current

and delinquent property taxes. The fee for this service is $0.98 per account.

In Thousands PROPERTY TAX REVENUE

$8,000

$7,000 $6,430 $6,806

$6,000 $5,485 $5,930

$5,000 $3,847 $4,310 $4,627

$4,000 $3,500 $3,519 $3,789

In Thousands

$3,000 DELINQUENT PROPERTY TAX REVENUES

$2,000

$1,000

0

$0

12-13 13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22

SALES TAX

The total sales tax rate for the City of Saginaw is two percent (2%). The tax is split as follows; one-eighth

of one percent to provide revenue for maintenance and repairs of existing municipal streets and sidewalks

(Street Maintenance Fund), three-eighths of one percent for the Crime Control and Prevention District

(CCPD Fund), one-half of one percent to reduce property taxes and one percent for General Fund

revenues.

These graphs represent the one cent sales tax that is collected for the General Fund and the citizen-

approved one-half cent sales tax that is collected to reduce the property tax. The FY21/22 estimate is

lower than FY20/21 due to a one time audit payment received in FY20/21.

In Thousands PENALTY & INTEREST REVENUES

SALES TAX REVENUES

In Thousands

30

$7,000 $5,500 $6,452

$6,000 $4,700 $4,823 $5,153 $5,789

24

$5,000 $4,255 $4,348 $4,404 $4,398

18

$4,000 0

$3,000 0 0

12

$2,000 0 0 0 0

6

$1,000 0 0 0

0 $0

12-13 13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22

FRANCHISE FEES - UTILITIES

Franchise taxes are fees paid by utilities and other industries for the use of streets, right-of-ways and

other city property to distribute their services. Utility companies that pay the City franchise taxes include

Oncor Electric, Atmos Gas and Southwestern Bell. Revenue for 13-14 reflected the change in timing of

electric franchise fees. Projected revenue is based on weather of a typical year.

In Thousands FRANCHISE FEE REVENUES - UTILITIES

$1,500

$1,279 $1,309 $1,220 $1,227 $1,310 $1,188 $1,199 $1,205

$1,021

$1,000

$849

In Thousands SALES TAX REVENUES

$500

$0

0

12-13 13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22

62