Page 63 - Saginaw FY22 Adopted Annual Budget

P. 63

CITY OF SAGINAW

BUDGET DETAIL

2021-2022

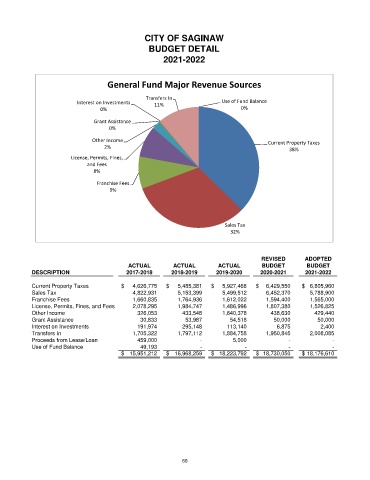

General Fund Major Revenue Sources

Transfers In

Interest on Investments 11% Use of Fund Balance

0% 0%

Grant Assistance

0%

Other Income

Current Property Taxes

2% 38%

License, Permits, Fines,

and Fees

8%

Franchise Fees

9%

Sales Tax

32%

REVISED ADOPTED

ACTUAL ACTUAL ACTUAL BUDGET BUDGET

DESCRIPTION 2017-2018 2018-2019 2019-2020 2020-2021 2021-2022

Current Property Taxes $ 4,626,775 $ 5,485,381 $ 5,927,468 $ 6,429,550 $ 6,805,960

Sales Tax 4,822,931 5,153,399 5,499,512 6,452,370 5,788,900

Franchise Fees 1,660,835 1,764,936 1,612,022 1,594,400 1,565,000

License, Permits, Fines, and Fees 2,078,295 1,984,747 1,486,996 1,807,380 1,526,825

Other Income 326,053 433,548 1,640,378 438,630 429,440

Grant Assistance 30,833 53,987 54,518 50,000 50,000

Interest on Investments 191,974 295,148 113,140 6,875 2,400

Transfers In 1,705,322 1,797,112 1,884,758 1,950,845 2,008,085

Proceeds from Lease/Loan 459,000 - 5,000 - -

Use of Fund Balance 49,193 - - - -

$ 15,951,212 $ 16,968,259 $ 18,223,792 $ 18,730,050 $ 18,176,610

60