Page 27 - Saginaw FY22 Adopted Annual Budget

P. 27

CITY OF SAGINAW

BUDGET HIGHLIGHTS

2021-2022

The following is a brief overview of the adopted 2021-2022 budget:

GENERAL FUND:

• The City of Saginaw continues to see growth in the estimated net taxable value due to

continued residential growth and an overall increase in property values. The July 2021

certified net taxable value has increased by 8.6% over the July 2020 certified net taxable

value. These taxable values are determined and certified by the Tarrant Appraisal

District (TAD).

• Saginaw’s population has grown from 12,374 in 2000 to 19,806 per the 2010 census.

The North Central Texas Council of Governments estimates the 2021 population to be

23,380.

• The July certified estimated net taxable value from TAD is $2,387,571,997. This is an

increase of $189,062,771 over last year’s July estimated net taxable value of

$2,198,509,226. Tarrant Appraisal District estimates a total of $39,728,389 in added

value from new construction ($39,579,117 in residential and $149,272 in commercial).

New construction for 2019-2020 was valued at $56,778,169.

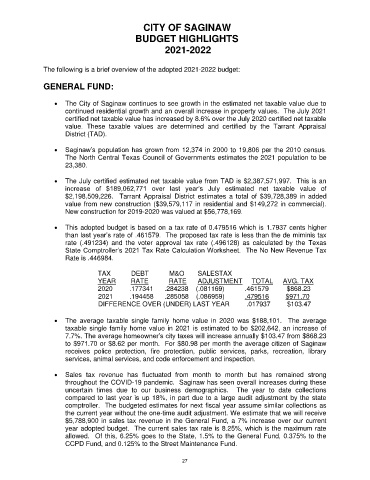

• This adopted budget is based on a tax rate of 0.479516 which is 1.7937 cents higher

than last year’s rate of .461579. The proposed tax rate is less than the de miminis tax

rate (.491234) and the voter approval tax rate (.496128) as calculated by the Texas

State Comptroller’s 2021 Tax Rate Calculation Worksheet. The No New Revenue Tax

Rate is .446984.

TAX DEBT M&O SALESTAX

YEAR RATE RATE ADJUSTMENT TOTAL AVG. TAX

2020 .177341 .284238 (.081169) .461579 $868.23

2021 .194458 .285058 (.086959) .479516 $971.70

DIFFERENCE OVER (UNDER) LAST YEAR .017937 $103.47

• The average taxable single family home value in 2020 was $188,101. The average

taxable single family home value in 2021 is estimated to be $202,642, an increase of

7.7%. The average homeowner’s city taxes will increase annually $103.47 from $868.23

to $971.70 or $8.62 per month. For $80.98 per month the average citizen of Saginaw

receives police protection, fire protection, public services, parks, recreation, library

services, animal services, and code enforcement and inspection.

• Sales tax revenue has fluctuated from month to month but has remained strong

throughout the COVID-19 pandemic. Saginaw has seen overall increases during these

uncertain times due to our business demographics. The year to date collections

compared to last year is up 18%, in part due to a large audit adjustment by the state

comptroller. The budgeted estimates for next fiscal year assume similar collections as

the current year without the one-time audit adjustment. We estimate that we will receive

$5,788,900 in sales tax revenue in the General Fund, a 7% increase over our current

year adopted budget. The current sales tax rate is 8.25%, which is the maximum rate

allowed. Of this, 6.25% goes to the State, 1.5% to the General Fund, 0.375% to the

CCPD Fund, and 0.125% to the Street Maintenance Fund.

27