Page 61 - City of Mansfield FY22 Operarting Budget

P. 61

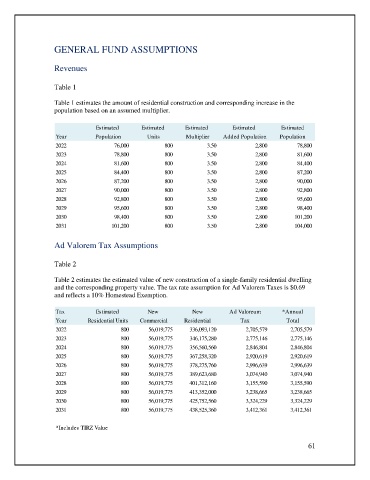

GENERAL FUND ASSUMPTIONS

Revenues

Table 1

Table 1 estimates the amount of residential construction and corresponding increase in the

population based on an assumed multiplier.

Estimated Estimated Estimated Estimated Estimated

Year Population Units Multiplier Added Population Population

2022 76,000 800 3.50 2,800 78,800

2023 78,800 800 3.50 2,800 81,600

2024 81,600 800 3.50 2,800 84,400

2025 84,400 800 3.50 2,800 87,200

2026 87,200 800 3.50 2,800 90,000

2027 90,000 800 3.50 2,800 92,800

2028 92,800 800 3.50 2,800 95,600

2029 95,600 800 3.50 2,800 98,400

2030 98,400 800 3.50 2,800 101,200

2031 101,200 800 3.50 2,800 104,000

Ad Valorem Tax Assumptions

Table 2

Table 2 estimates the estimated value of new construction of a single-family residential dwelling

and the corresponding property value. The tax rate assumption for Ad Valorem Taxes is $0.69

and reflects a 10% Homestead Exemption.

Tax Estimated New New Ad Valoreum *Annual

Year Residential Units Commercial Residential Tax Total

2022 800 56,019,775 336,093,120 2,705,579 2,705,579

2023 800 56,019,775 346,175,280 2,775,146 2,775,146

2024 800 56,019,775 356,560,560 2,846,804 2,846,804

2025 800 56,019,775 367,258,320 2,920,619 2,920,619

2026 800 56,019,775 378,275,760 2,996,639 2,996,639

2027 800 56,019,775 389,623,680 3,074,940 3,074,940

2028 800 56,019,775 401,312,160 3,155,590 3,155,590

2029 800 56,019,775 413,352,000 3,238,665 3,238,665

2030 800 56,019,775 425,752,560 3,324,229 3,324,229

2031 800 56,019,775 438,525,360 3,412,361 3,412,361

*Includes TIRZ Value

61