Page 23 - Microsoft Word - FY 2021 tax info sheet

P. 23

Strategy 3.3: Strive to Ensure that Keller’s Taxpayers Do Not Pay More City Tax Dollars on a Year‐to‐

Year Basis

No New Revenue Rate

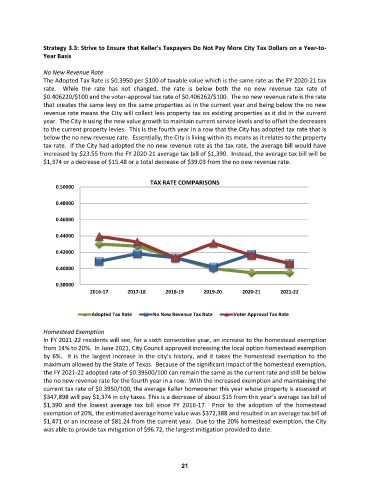

The Adopted Tax Rate is $0.3950 per $100 of taxable value which is the same rate as the FY 2020‐21 tax

rate. While the rate has not changed, the rate is below both the no new revenue tax rate of

$0.406220/$100 and the voter‐approval tax rate of $0.406262/$100. The no new revenue rate is the rate

that creates the same levy on the same properties as in the current year and being below the no new

revenue rate means the City will collect less property tax on existing properties as it did in the current

year. The City is using the new value growth to maintain current service levels and to offset the decreases

to the current property levies. This is the fourth year in a row that the City has adopted tax rate that is

below the no new revenue rate. Essentially, the City is living within its means as it relates to the property

tax rate. If the City had adopted the no new revenue rate as the tax rate, the average bill would have

increased by $23.55 from the FY 2020‐21 average tax bill of $1,390. Instead, the average tax bill will be

$1,374 or a decrease of $15.48 or a total decrease of $39.03 from the no new revenue rate.

TAX RATE COMPARISONS

0.50000

0.48000

0.46000

0.44000

0.42000

0.40000

0.38000

2016‐17 2017‐18 2018‐19 2019‐20 2020‐21 2021‐22

Adopted Tax Rate No New Revenue Tax Rate Voter Approval Tax Rate

Homestead Exemption

In FY 2021‐22 residents will see, for a sixth consecutive year, an increase to the homestead exemption

from 14% to 20%. In June 2021, City Council approved increasing the local option homestead exemption

by 6%. It is the largest increase in the city’s history, and it takes the homestead exemption to the

maximum allowed by the State of Texas. Because of the significant impact of the homestead exemption,

the FY 2021‐22 adopted rate of $0.39500/100 can remain the same as the current rate and still be below

the no new revenue rate for the fourth year in a row. With the increased exemption and maintaining the

current tax rate of $0.3950/100, the average Keller homeowner this year whose property is assessed at

$347,898 will pay $1,374 in city taxes. This is a decrease of about $15 from this year’s average tax bill of

$1,390 and the lowest average tax bill since FY 2016‐17. Prior to the adoption of the homestead

exemption of 20%, the estimated average home value was $372,388 and resulted in an average tax bill of

$1,471 or an increase of $81.24 from the current year. Due to the 20% homestead exemption, the City

was able to provide tax mitigation of $96.72, the largest mitigation provided to date.

21