Page 127 - Microsoft Word - FY 2021 tax info sheet

P. 127

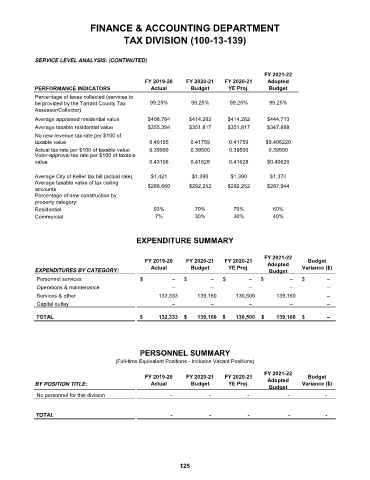

FINANCE & ACCOUNTING DEPARTMENT

TAX DIVISION (100-13-139)

SERVICE LEVEL ANALYSIS: (CONTINUTED)

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted

PERFORMANCE INDICATORS Actual Budget YE Proj. Budget

Percentage of taxes collected (services to

be provided by the Tarrant County Tax 99.25% 99.25% 99.25% 99.25%

Assessor/Collector)

Average appraised residential value $408,784 $414,262 $414,262 $444,713

Average taxable residential value $355,394 $351,817 $351,817 $347,898

No new revenue tax rate per $100 of

taxable value 0.40195 0.41759 0.41759 $0.406220

Actual tax rate per $100 of taxable value 0.39990 0.39500 0.39500 0.39500

Voter-approval tax rate per $100 of taxable

value 0.43106 0.41628 0.41628 $0.40626

Average City of Keller tax bill (actual rate) $1,421 $1,390 $1,390 $1,374

Average taxable value of tax ceiling

accounts $288,660 $292,252 $292,252 $287,944

Percentage of new construction by

property category:

Residential 93% 70% 70% 60%

Commercial 7% 30% 30% 40%

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance – – – – –

Services & other 132,333 139,160 130,500 139,160 –

Capital outlay – – – – –

TOTAL $ 132,333 $ 139,160 $ 130,500 $ 139,160 $ –

PERSONNEL SUMMARY

(Full-time Equivalent Positions - Includes Vacant Positions)

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Budget

BY POSITION TITLE: Actual Budget YE Proj. Adopted Variance ($)

Budget

No personnel for this division - - - - -

TOTAL - - - - -

125