Page 86 - Hurst Adopted FY22 Budget

P. 86

APPROVED FISCAL YEAR 2022 BUDGET

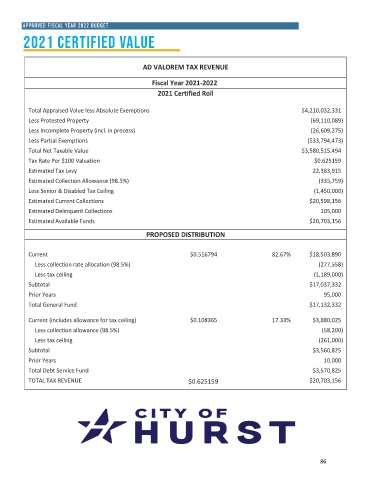

2021 certified value

AD VALOREM TAX REVENUE

Fiscal Year 2021-2022

2021 Certified Roll

Total Appraised Value less Absolute Exemptions $4,210,032,331

Less Protested Property (69,110,089)

Less Incomplete Property (incl. in process) (26,609,275)

Less Partial Exemptions (533,794,473)

Total Net Taxable Value $3,580,515,494

Tax Rate Per $100 Valuation $0.625159

Estimated Tax Levy 22,383,915

Estimated Collection Allowance (98.5%) (335,759)

Less Senior & Disabled Tax Ceiling (1,450,000)

Estimated Current Collections $20,598,156

Estimated Delinquent Collections 105,000

Estimated Available Funds $20,703,156

PROPOSED DISTRIBUTION

Current $0.516794 82.67% $18,503,890

Less collection rate allocation (98.5%) (277,558)

Less tax ceiling (1,189,000)

Subtotal $17,037,332

Prior Years 95,000

Total General Fund $17,132,332

Current (includes allowance for tax ceiling) $0.108365 17.33% $3,880,025

Less collection allowance (98.5%) (58,200)

Less tax ceiling (261,000)

Subtotal $3,560,825

Prior Years 10,000

Total Debt Service Fund $3,570,825

TOTAL TAX REVENUE $0.625159 $20,703,156

86