Page 89 - Hurst Adopted FY22 Budget

P. 89

APPROVED FISCAL YEAR 2022 BUDGET

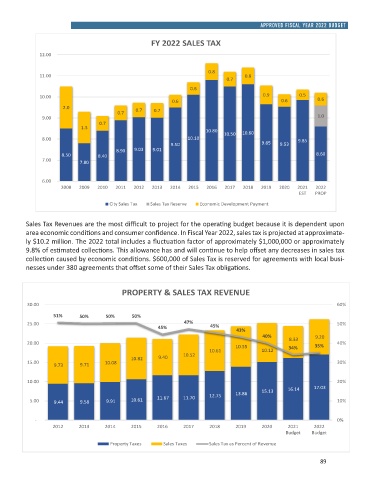

FY 2022 SALES TAX

12.00

0.8

11.00 0.8

0.7

0.6

10.00 0.9 0.5

0.6 0.6 0.6

2.0 0.7

0.7 0.7

9.00 1.0

0.7

1.5

10.80 10.50 10.60

8.00 10.10 9.85

9.50 9.65 9.53

8.90 9.03 9.01

8.50 8.40 8.60

7.00 7.80

6.00

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

EST PROP

City Sales Tax Sales Tax Reserve Economic Development Payment

Sales Tax Revenues are the most difficult to project for the operating budget because it is dependent upon

area economic conditions and consumer confidence. In Fiscal Year 2022, sales tax is projected at approximate-

ly $10.2 million. The 2022 total includes a fluctuation factor of approximately $1,000,000 or approximately

9.8% of estimated collections. This allowance has and will continue to help offset any decreases in sales tax

collection caused by economic conditions. $600,000 of Sales Tax is reserved for agreements with local busi-

nesses under 380 agreements that offset some of their Sales Tax obligations.

PROPERTY & SALES TAX REVENUE

30.00 60%

51% 50% 50% 50%

25.00 47% 50%

45% 45% 43%

40% 8.33 9.20

20.00 10.55 35% 40%

10.61 10.12 34%

10.82 9.40 10.52

15.00 10.08 30%

9.73 9.71

10.00 20%

15.13 16.14 17.03

13.86

5.00 9.44 9.58 9.91 10.61 11.67 11.70 12.75 10%

- 0%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Budget Budget

Property Taxes Sales Taxes Sales Tax as Percent of Revenue

89