Page 82 - Hurst Adopted FY22 Budget

P. 82

APPROVED FISCAL YEAR 2022 BUDGET

general fund revenues

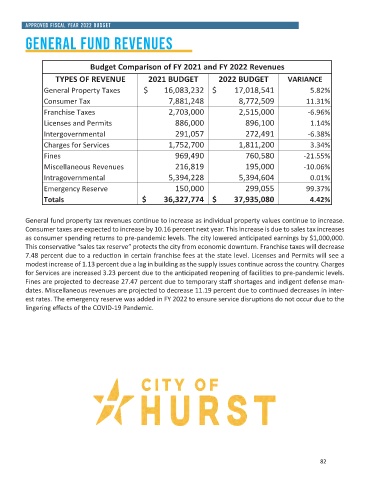

Budget Comparison of FY 2021 and FY 2022 Revenues

TYPES OF REVENUE 2021 BUDGET 2022 BUDGET VARIANCE

General Property Taxes $ 16,083,232 $ 17,018,541 5.82%

Consumer Tax 7,881,248 8,772,509 11.31%

Franchise Taxes 2,703,000 2,515,000 -6.96%

Licenses and Permits 886,000 896,100 1.14%

Intergovernmental 291,057 272,491 -6.38%

Charges for Services 1,752,700 1,811,200 3.34%

Fines 969,490 760,580 -21.55%

Miscellaneous Revenues 216,819 195,000 -10.06%

Intragovernmental 5,394,228 5,394,604 0.01%

Emergency Reserve 150,000 299,055 99.37%

Totals $ 36,327,774 $ 37,935,080 4.42%

General fund property tax revenues continue to increase as individual property values continue to increase.

Consumer taxes are expected to increase by 10.16 percent next year. This increase is due to sales tax increases

as consumer spending returns to pre-pandemic levels. The city lowered anticipated earnings by $1,000,000.

This conservative “sales tax reserve” protects the city from economic downturn. Franchise taxes will decrease

7.48 percent due to a reduction in certain franchise fees at the state level. Licenses and Permits will see a

modest increase of 1.13 percent due a lag in building as the supply issues continue across the country. Charges

for Services are increased 3.23 percent due to the anticipated reopening of facilities to pre-pandemic levels.

Fines are projected to decrease 27.47 percent due to temporary staff shortages and indigent defense man-

dates. Miscellaneous revenues are projected to decrease 11.19 percent due to continued decreases in inter-

est rates. The emergency reserve was added in FY 2022 to ensure service disruptions do not occur due to the

lingering effects of the COVID-19 Pandemic.

82