Page 119 - Hurst Adopted FY22 Budget

P. 119

APPROVED FISCAL YEAR 2022 BUDGET

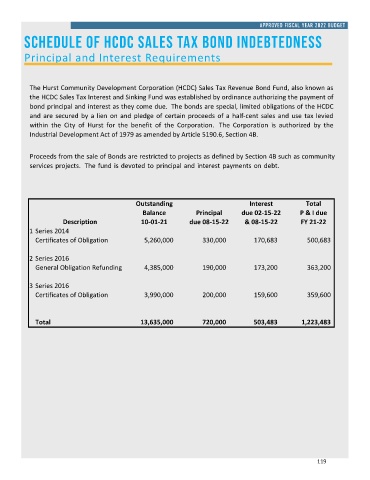

schedule of HCDC Sales Tax Bond Indebtedness

Principal and Interest Requirements

The Hurst Community Development Corporation (HCDC) Sales Tax Revenue Bond Fund, also known as

the HCDC Sales Tax Interest and Sinking Fund was established by ordinance authorizing the payment of

bond principal and interest as they come due. The bonds are special, limited obligations of the HCDC

and are secured by a lien on and pledge of certain proceeds of a half-cent sales and use tax levied

within the City of Hurst for the benefit of the Corporation. The Corporation is authorized by the

Industrial Development Act of 1979 as amended by Article 5190.6, Section 4B.

Proceeds from the sale of Bonds are restricted to projects as defined by Section 4B such as community

services projects. The fund is devoted to principal and interest payments on debt.

Outstanding Interest Total

Balance Principal due 02-15-22 P & I due

Description 10-01-21 due 08-15-22 & 08-15-22 FY 21-22

1 Series 2014

Certificates of Obligation 5,260,000 330,000 170,683 500,683

2 Series 2016

General Obligation Refunding 4,385,000 190,000 173,200 363,200

3 Series 2016

Certificates of Obligation 3,990,000 200,000 159,600 359,600

Total 13,635,000 720,000 503,483 1,223,483

119