Page 115 - Hurst Adopted FY22 Budget

P. 115

APPROVED FISCAL YEAR 2022 BUDGET

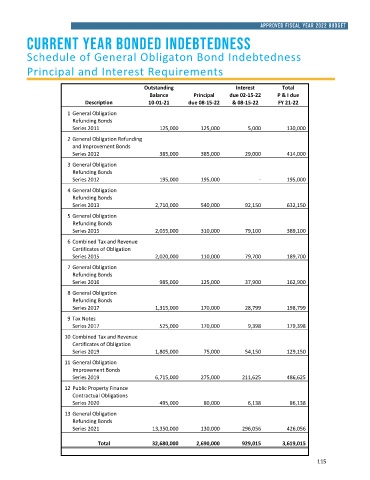

current year bonded indebtedness

Schedule of General Obligaton Bond Indebtedness

Principal and Interest Requirements

Outstanding Interest Total

Balance Principal due 02-15-22 P & I due

Description 10-01-21 due 08-15-22 & 08-15-22 FY 21-22

1 General Obligation

Refunding Bonds

Series 2011 125,000 125,000 5,000 130,000

2 General Obligation Refunding

and Improvement Bonds

Series 2012 385,000 385,000 29,000 414,000

3 General Obligation

Refunding Bonds

Series 2012 195,000 195,000 - 195,000

4 General Obligation

Refunding Bonds

Series 2013 2,710,000 540,000 92,150 632,150

5 General Obligation

Refunding Bonds

Series 2015 2,055,000 310,000 79,100 389,100

6 Combined Tax and Revenue

Certificates of Obligation

Series 2015 2,020,000 110,000 79,700 189,700

7 General Obligation

Refunding Bonds

Series 2016 985,000 125,000 37,900 162,900

8 General Obligation

Refunding Bonds

Series 2017 1,315,000 170,000 28,799 198,799

9 Tax Notes

Series 2017 525,000 170,000 9,398 179,398

10 Combined Tax and Revenue

Certificates of Obligation

Series 2019 1,805,000 75,000 54,150 129,150

11 General Obligation

Improvement Bonds

Series 2019 6,715,000 275,000 211,625 486,625

12 Public Property Finance

Contractual Obligations

Series 2020 495,000 80,000 6,138 86,138

13 General Obligation

Refunding Bonds

Series 2021 13,350,000 130,000 296,056 426,056

Total 32,680,000 2,690,000 929,015 3,619,015

115