Page 49 - Haltom City FY 22 Budget

P. 49

CITY OF HALTOM CITY ANNUAL BUDGET, FY2022 Budget overview

MAJOR REVENUES

PROPERTY TAX

The City’s property tax is levied based on appraised value of property as determined by the Tarrant

County Appraisal District. The Tarrant County Tax Office bills and collects the property tax for the

City.

The combined tax rate is $0.64565 per $100 assessed valuation, which consists of $0.39577 for

maintenance and operations cost (recorded in the General Fund) and $0.24988 for principal and

interest payments on bond indebtedness (recorded in the Debt Service Fund).

Outlook

Property tax revenues for FY2022 has increased by 7.7% due to the increase in property values.

Property value is based on the certified tax roll from the Tarrant County Appraisal District. For

future years, the growth should continue as more of the developments are completed and newer

properties are included on the tax rolls.

Major Influence

Factors affecting property tax revenues include population, development, property value, tax rate

and tax assessor appraisal and collection rate.

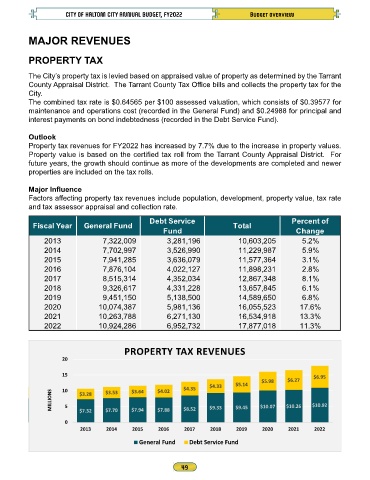

Debt Service Percent of

Fiscal Year General Fund Total

Fund Change

2013 7,322,009 3,281,196 10,603,205 5.2%

2014 7,702,997 3,526,990 11,229,987 5.9%

2015 7,941,285 3,636,079 11,577,364 3.1%

2016 7,876,104 4,022,127 11,898,231 2.8%

2017 8,515,314 4,352,034 12,867,348 8.1%

2018 9,326,617 4,331,228 13,657,845 6.1%

2019 9,451,150 5,138,500 14,589,650 6.8%

2020 10,074,387 5,981,136 16,055,523 17.6%

2021 10,263,788 6,271,130 16,534,918 13.3%

2022 10,924,286 6,952,732 17,877,018 11.3%

PROPERTY TAX REVENUES

20

15 $6.95

$5.98 $6.27

$5.14

$4.33

$4.35

10

$4.02

MILLIONS 5 $3.28 $3.53 $3.64 $7.88 $8.52 $9.33 $9.45 $10.07 $10.26 $10.92

$7.94

$7.70

$7.32

0

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

General Fund Debt Service Fund