Page 44 - Haltom City FY 22 Budget

P. 44

CITY OF HALTOM CITY ANNUAL BUDGET, FY2022 Budget overview

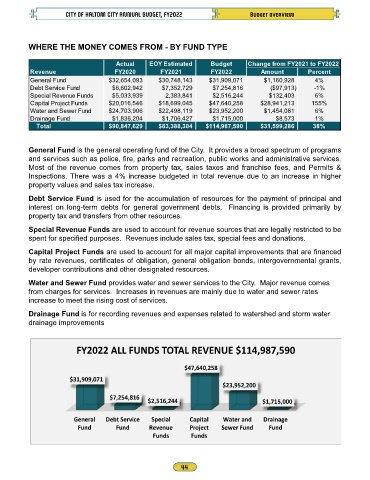

WHERE THE MONEY COMES FROM - BY FUND TYPE

Actual EOY Estimated Budget Change from FY2021 to FY2022

Revenue FY2020 FY2021 FY2022 Amount Percent

General Fund $32,654,093 $30,748,143 $31,909,071 $1,160,928 4%

Debt Service Fund $6,602,942 $7,352,729 $7,254,816 ($97,913) -1%

Special Revenue Funds $5,033,939 2,383,841 $2,516,244 $132,403 6%

Capital Project Funds $20,016,546 $18,699,045 $47,640,258 $28,941,213 155%

Water and Sewer Fund $24,703,906 $22,498,119 $23,952,200 $1,454,081 6%

Drainage Fund $1,836,204 $1,706,427 $1,715,000 $8,573 1%

Total $90,847,629 $83,388,304 $114,987,590 $31,599,286 38%

General Fund is the general operating fund of the City. It provides a broad spectrum of programs

and services such as police, fire, parks and recreation, public works and administrative services.

Most of the revenue comes from property tax, sales taxes and franchise fees, and Permits &

Inspections. There was a 4% increase budgeted in total revenue due to an increase in higher

property values and sales tax increase.

Debt Service Fund is used for the accumulation of resources for the payment of principal and

interest on long-term debts for general government debts. Financing is provided primarily by

property tax and transfers from other resources.

Special Revenue Funds are used to account for revenue sources that are legally restricted to be

spent for specified purposes. Revenues include sales tax, special fees and donations.

Capital Project Funds are used to account for all major capital improvements that are financed

by rate revenues, certificates of obligation, general obligation bonds, intergovernmental grants,

developer contributions and other designated resources.

Water and Sewer Fund provides water and sewer services to the City. Major revenue comes

from charges for services. Increases in revenues are mainly due to water and sewer rates

increase to meet the rising cost of services.

Drainage Fund is for recording revenues and expenses related to watershed and storm water

drainage improvements

FY2022 ALL FUNDS TOTAL REVENUE $114,987,590

$47,640,258

$31,909,071

$23,952,200

$7,254,816

$2,516,244 $1,715,000

General Debt Service Special Capital Water and Drainage

Fund Fund Revenue Project Sewer Fund Fund

Funds Funds