Page 69 - Grapevine FY22 Adopted Budget v2

P. 69

Sales & Use Taxes are the largest General Government revenue stream, at 36%. This category

contains both sales and mixed beverage taxes. Sales tax receipts are the result of a tax levy on the

sale of goods and services within the City as authorized by the state of Texas. The maximum sales

tax allowed for the City of Grapevine’s general fund is one cent per dollar on all goods and

services deemed taxable. Alcoholic beverage taxes are the result of mixed beverage and private

club registrants remitting a 14% mixed beverage gross receipts tax to the state. The state then

remits 8.3065% of those taxes to the City.

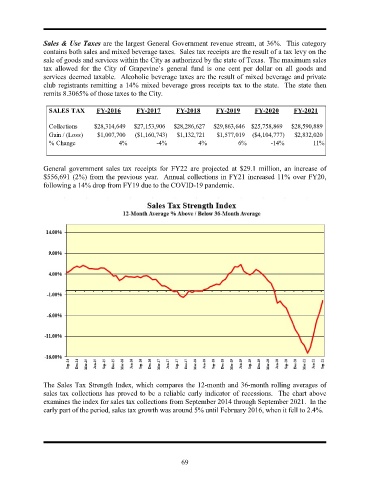

SALES TAX FY-2016 FY-2017 FY-2018 FY-2019 FY-2020 FY-2021

Collections $28,314,649 $27,153,906 $28,286,627 $29,863,646 $25,758,869 $28,590,889

Gain / (Loss) $1,007,700 ($1,160,743) $1,132,721 $1,577,019 ($4,104,777) $2,832,020

% Change 4% -4% 4% 6% -14% 11%

General government sales tax receipts for FY22 are projected at $29.1 million, an increase of

$556,691 (2%) from the previous year. Annual collections in FY21 increased 11% over FY20,

following a 14% drop from FY19 due to the COVID-19 pandemic.

The Sales Tax Strength Index, which compares the 12-month and 36-month rolling averages of

sales tax collections has proved to be a reliable early indicator of recessions. The chart above

examines the index for sales tax collections from September 2014 through September 2021. In the

early part of the period, sales tax growth was around 5% until February 2016, when it fell to 2.4%.

69