Page 67 - Grapevine FY22 Adopted Budget v2

P. 67

Revenue and Other Financing Sources

General Government revenue is budgeted at $85.8 million, an increase of $5.6 million (7%) from

the previous year. The increase in budgeted revenue is primarily due to higher Sales and Use tax

collections, which are budgeted to increase by $4.7 million from the prior year.

Ad Valorem Taxes, or property taxes, are levied each October 1 on the assessed value listed as of

the prior January 1 for all real and personal property located within the City. Assessed values

represent the appraised value less applicable exemptions authorized by the City Council.

Appraised values are established by the Tarrant Appraisal District (TAD) at 100% of estimated

market value. Taxes are due October 1, immediately following the January 1 lien date, and are

delinquent after the following January 13. Delinquent taxes are subject to a 15% penalty and 6%

interest according to Texas state law.

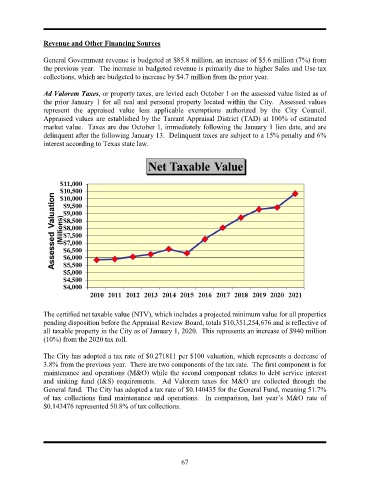

The certified net taxable value (NTV), which includes a projected minimum value for all properties

pending disposition before the Appraisal Review Board, totals $10,351,254,676 and is reflective of

all taxable property in the City as of January 1, 2020. This represents an increase of $940 million

(10%) from the 2020 tax roll.

The City has adopted a tax rate of $0.271811 per $100 valuation, which represents a decrease of

3.8% from the previous year. There are two components of the tax rate. The first component is for

maintenance and operations (M&O) while the second component relates to debt service interest

and sinking fund (I&S) requirements. Ad Valorem taxes for M&O are collected through the

General fund. The City has adopted a tax rate of $0.140435 for the General Fund, meaning 51.7%

of tax collections fund maintenance and operations. In comparison, last year’s M&O rate of

$0.143476 represented 50.8% of tax collections.

67