Page 70 - FortWorthFY22AdoptedBudget

P. 70

Budget Highlights

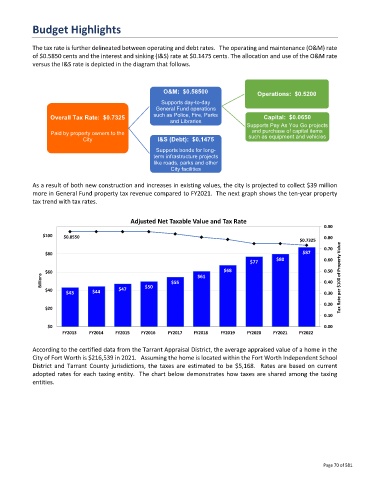

The tax rate is further delineated between operating and debt rates. The operating and maintenance (O&M) rate

of $0.5850 cents and the interest and sinking (I&S) rate at $0.1475 cents. The allocation and use of the O&M rate

versus the I&S rate is depicted in the diagram that follows.

O&M: $0.58500 Operations: $0.5200

Supports day-to-day

General Fund operations

Overall Tax Rate: $0.7325 such as Police, Fire, Parks Capital: $0.0650

and Libraries

Supports Pay As You Go projects

and purchase of capital items

Paid by property owners to the such as equipment and vehicles

City I&S (Debt): $0.1475

Supports bonds for long-

term infrastructure projects

like roads, parks and other

City facilities

As a result of both new construction and increases in existing values, the city is projected to collect $39 million

more in General Fund property tax revenue compared to FY2021. The next graph shows the ten-year property

tax trend with tax rates.

Adjusted Net Taxable Value and Tax Rate

0.90

$100 $0.8550 0.80

$0.7325

0.70

$80 $87

$80 0.60

$77

$60 $61 $68 0.50

Billions $55 0.40 Tax Rate per $100 of Property Value

$40 $44 $47 $50

$43 0.30

0.20

$20

0.10

$0 0.00

FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022

According to the certified data from the Tarrant Appraisal District, the average appraised value of a home in the

City of Fort Worth is $216,539 in 2021. Assuming the home is located within the Fort Worth Independent School

District and Tarrant County jurisdictions, the taxes are estimated to be $5,168. Rates are based on current

adopted rates for each taxing entity. The chart below demonstrates how taxes are shared among the taxing

entities.

Page 70 of 581