Page 51 - FortWorthFY22AdoptedBudget

P. 51

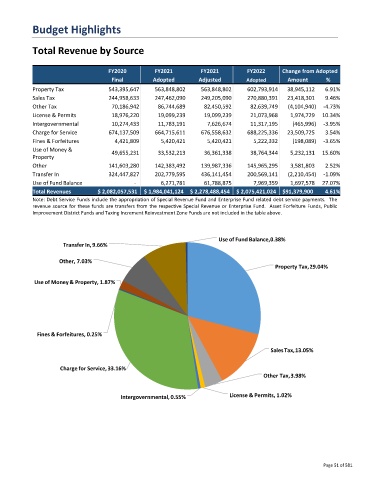

Budget Highlights

Total Revenue by Source

FY2020 FY2021 FY2021 FY2022 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 543,395,647 563,848,802 563,848,802 602,793,914 38,945,112 6.91%

Sales Tax 244,958,633 247,462,090 249,205,090 270,880,391 23,418,301 9.46%

Other Tax 70,186,942 86,744,689 82,450,592 82,639,749 (4,104,940) -4.73%

License & Permits 18,976,220 19,099,239 19,099,239 21,073,968 1,974,729 10.34%

Intergovernmental 10,274,433 11,783,191 7,626,674 11,317,195 (465,996) -3.95%

Charge for Service 674,137,509 664,715,611 676,558,632 688,225,336 23,509,725 3.54%

Fines & Forfeitures 4,421,809 5,420,421 5,420,421 5,222,332 (198,089) -3.65%

Use of Money & 49,655,231 33,532,213 36,361,338 38,764,344 5,232,131 15.60%

Property

Other 141,603,280 142,383,492 139,987,336 145,965,295 3,581,803 2.52%

Transfer In 324,447,827 202,779,595 436,141,454 200,569,141 (2,210,454) -1.09%

Use of Fund Balance - 6,271,781 61,788,875 7,969,359 1,697,578 27.07%

Total Revenues $ 2,082,057,531 $ 1,984,041,124 $ 2,278,488,454 $ 2,075,421,024 $91,379,900 4.61%

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these funds are transfers from the respective Special Revenue or Enterprise Fund. Asset Forfeiture Funds, Public

Improvement District Funds and Taxing Increment Reinvestment Zone Funds are not included in the table above.

Use of Fund Balance,0.38%

TransferIn,9.66%

Other, 7.03%

Property Tax,29.04%

Use of Money& Property, 1.87%

Fines & Forfeitures, 0.25%

SalesTax,13.05%

Charge for Service,33.16%

Other Tax,3.98%

Intergovernmental, 0.55% License & Permits, 1.02%

Page 51 of 581