Page 31 - FortWorthFY22AdoptedBudget

P. 31

Executive Message

end budget projections, tax revenue is expected to increase in FY2022 by 8.70%, or $14.6M, from budgeted

FY2021 sales tax and is budgeted at $182,885,742.

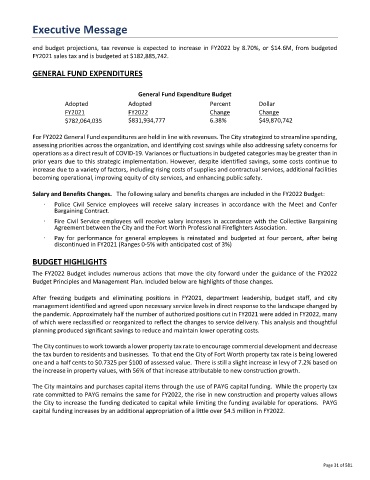

GENERAL FUND EXPENDITURES

General Fund Expenditure Budget

Adopted Adopted Percent Dollar

FY2021 FY2022 Change Change

$782,064,035 $831,934,777 6.38% $49,870,742

For FY2022 General Fund expenditures are held in line with revenues. The City strategized to streamline spending,

assessing priorities across the organization, and identifying cost savings while also addressing safety concerns for

operations as a direct result of COVID-19. Variances or fluctuations in budgeted categories may be greater than in

prior years due to this strategic implementation. However, despite identified savings, some costs continue to

increase due to a variety of factors, including rising costs of supplies and contractual services, additional facilities

becoming operational, improving equity of city services, and enhancing public safety.

Salary and Benefits Changes. The following salary and benefits changes are included in the FY2022 Budget:

· Police Civil Service employees will receive salary increases in accordance with the Meet and Confer

Bargaining Contract.

· Fire Civil Service employees will receive salary increases in accordance with the Collective Bargaining

Agreement between the City and the Fort Worth Professional Firefighters Association.

· Pay for performance for general employees is reinstated and budgeted at four percent, after being

discontinued in FY2021 (Ranges 0-5% with anticipated cost of 3%)

BUDGET HIGHLIGHTS

The FY2022 Budget includes numerous actions that move the city forward under the guidance of the FY2022

Budget Principles and Management Plan. Included below are highlights of those changes.

After freezing budgets and eliminating positions in FY2021, department leadership, budget staff, and city

management identified and agreed upon necessary service levels in direct response to the landscape changed by

the pandemic. Approximately half the number of authorized positions cut in FY2021 were added in FY2022, many

of which were reclassified or reorganized to reflect the changes to service delivery. This analysis and thoughtful

planning produced significant savings to reduce and maintain lower operating costs.

The City continues to work towards a lower property tax rate to encourage commercial development and decrease

the tax burden to residents and businesses. To that end the City of Fort Worth property tax rate is being lowered

one and a half cents to $0.7325 per $100 of assessed value. There is still a slight increase in levy of 7.2% based on

the increase in property values, with 56% of that increase attributable to new construction growth.

The City maintains and purchases capital items through the use of PAYG capital funding. While the property tax

rate committed to PAYG remains the same for FY2022, the rise in new construction and property values allows

the City to increase the funding dedicated to capital while limiting the funding available for operations. PAYG

capital funding increases by an additional appropriation of a little over $4.5 million in FY2022.

Page 31 of 581