Page 192 - FortWorthFY22AdoptedBudget

P. 192

Special Revenue Fund

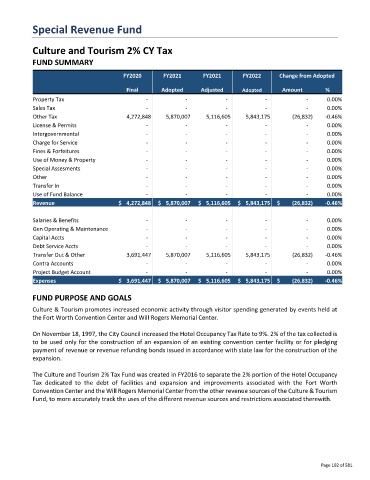

Culture and Tourism 2% CY Tax

FUND SUMMARY

FY2020 FY2021 FY2021 FY2022 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax - - - - - 0.00%

Sales Tax - - - - - 0.00%

Other Tax 4,272,848 5,870,007 5,116,605 5,843,175 (26,832) -0.46%

License & Permits - - - - - 0.00%

Intergovernmental - - - - - 0.00%

Charge for Service - - - - - 0.00%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property - - - - - 0.00%

Special Assesments - - - - - 0.00%

Other - - - - - 0.00%

Transfer In - - - - - 0.00%

Use of Fund Balance - - - - - 0.00%

Revenue $ 4,272,848 $ 5,870,007 $ 5,116,605 $ 5,843,175 $ (26,832) -0.46%

Salaries & Benefits - - - - - 0.00%

Gen Operating & Maintenance - - - - - 0.00%

Capital Accts - - - - - 0.00%

Debt Service Accts - - - - - 0.00%

Transfer Out & Other 3,691,447 5,870,007 5,116,605 5,843,175 (26,832) -0.46%

Contra Accounts - - - - - 0.00%

Project Budget Account - - - - - 0.00%

Expenses $ 3,691,447 $ 5,870,007 $ 5,116,605 $ 5,843,175 $ (26,832) -0.46%

FUND PURPOSE AND GOALS

Culture & Tourism promotes increased economic activity through visitor spending generated by events held at

the Fort Worth Convention Center and Will Rogers Memorial Center.

On November 18, 1997, the City Council increased the Hotel Occupancy Tax Rate to 9%. 2% of the tax collected is

to be used only for the construction of an expansion of an existing convention center facility or for pledging

payment of revenue or revenue refunding bonds issued in accordance with state law for the construction of the

expansion.

The Culture and Tourism 2% Tax Fund was created in FY2016 to separate the 2% portion of the Hotel Occupancy

Tax dedicated to the debt of facilities and expansion and improvements associated with the Fort Worth

Convention Center and the Will Rogers Memorial Center from the other revenue sources of the Culture & Tourism

Fund, to more accurately track the uses of the different revenue sources and restrictions associated therewith.

Page 192 of 581