Page 84 - Forest Hill FY22 Annual Budget

P. 84

DEBT SERVICE FUND

ForejHill For the Fiscal Year Beginning October 01, 2021

I I Development Fund (l&S Ad c:J

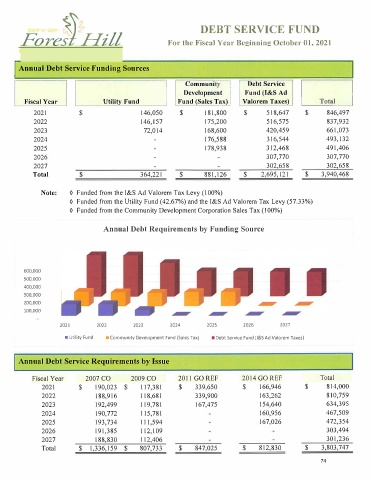

I Annual Debt Service Funding Sources

Debt Service

Communi

8

Fiscal Year Utility Fund Fund (Sales Tax) �lorem Taxes)

2021 $ 146,050 $ 181,800 $ 518,647 $ 846,497

2022 146,157 175,200 516,575 837,932

2023 72,014 168,600 420,459 661,073

2024 176,588 316,544 493,132

2025 178,938 312,468 491,406

2026 307,770 307,770

2027 302,658 302,658

Total $ 364,221 $ 881,126 $ 2,695,121 $ 3,940,468

Note: ◊ Funded from the l&S Ad Valorem Tax Levy (100%)

◊ Funded from the Utility Fund (42.67%) and the I&S Ad Valorem Tax Levy (57.33%)

◊ Funded from the Community Development Corporation Sales Tax ( I 00%)

Annual Debt Requirements by Funding Source

600,000

500,000

400,000

300,000

200,000

100,000

2021 2022 2023 2024 2025 2026 2027

■ Utility Fund ■ Community Development Fund {Sales Tax) ■ Debt Service Fund (1&5 Ad Valorem Taxes)

Annual Debt Service Requirements by Issue

Fiscal Year 2007 co 2009 co 2011 GO REF 2014 GO REF Total

2021 $ 190,023 $ 117,381 $ 339,650 $ 166,946 $ 814,000

2022 188,916 118,681 339,900 163,262 8 I 0,759

2023 192,499 119,781 167,475 154,640 634,395

2024 190,772 115,781 160,956 467,509

2025 193,734 111,594 167,026 472,354

2026 191,385 112,109 303,494

2027 188,830 112,406 301,236

Total $ 1,336,159 $ 807,733 $ 847,025 $ 812,830 $ 3,803,747

74