Page 83 - Forest Hill FY22 Annual Budget

P. 83

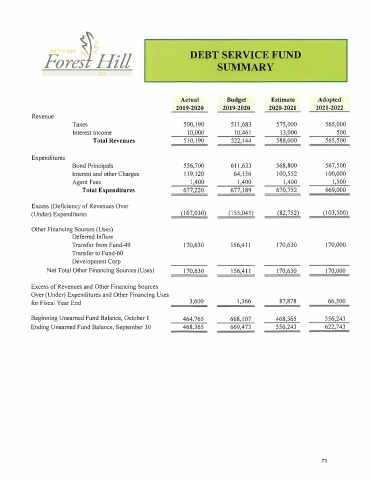

Fore�Hill DEBT SERVICE FUND

□ SUMMARY

Actual Budget Estimate Adopted

2019-2020 2019-2020 2020-2021 2021-2022

Revenue

Taxes 500,190 511,683 575,000 565,000

Interest Income 10,000 10,461 13,000 500

Total Revenues 510,190 522,144 588,000 565,500

Expenditures

Bond Principals 556,700 611,633 568,800 567,500

Interest and other Charges 119,120 64,156 100,552 100,000

Agent Fees 1,400 1,400 1,400 1,500

Total Expenditures 677,220 677,189 670,752 669,000

Excess (Deficiency of Revenues Over

(Under) Expenditures (167,030) (155,045) (82,752) (103,500)

Other Financing Sources (Uses)

Deferred Inflow

Transfer from Fund-49 170,630 156,411 170,630 170,000

Transfer to Fund-60

Development Corp

Net Total Other Financing Sources (Uses) 170,630 156,411 170,630 170,000

Excess of Revenues and Other Financing Sources

Over (Under) Expenditures and Other Financing Uses

for Fiscal Year End 3,600 1,366 87,878 66,500

Beginning Unearned Fund Balance, October I 464,765 668,107 468,365 556,243

Ending Unearned Fund Balance, September 30 468,365 669,473 556,243 622,743

73