Page 82 - Forest Hill FY22 Annual Budget

P. 82

DEBT SERVICE FUND (30)

C OJ

The Debt Service Fund (Interest and Sinking Fund, or I&S) was established for the purpose of servicing the

City's general obligation debt. Revenue sources for the fund include the interest and sinking (l&S) portion of

the annual ad valorem tax levy, tax collections penalties and interest, interest earnings, and inter-fund transfers.

Debt service payments are forwarded to the designated paying agent bank as semi-annual principal and interest

requirements come due for each debt issue.

I Ad Valorem Tax Rate

All taxable property within the City is subject to the assessment, levy and collection by the City of a continuing,

direct annual ad valorem tax sufficient to provide for the payment of principal of and interest on all ad valorem

tax debt within the limits prescribed by law. Article XI, Section 5, of the Texas Constitution is applicable to the

City, and limits its maximum ad valorem tax rate to $2.50 per$ 100 Taxable Assessed Valuation for all City

purposes.

The I&S portion of the voter-approval ad valorem tax rate for 2021-2022 is 0.11560 I per$ I 00 of assessed

valuation, or 11.6% of the total adopted tax rate of 1.047386 per $100 valuation.

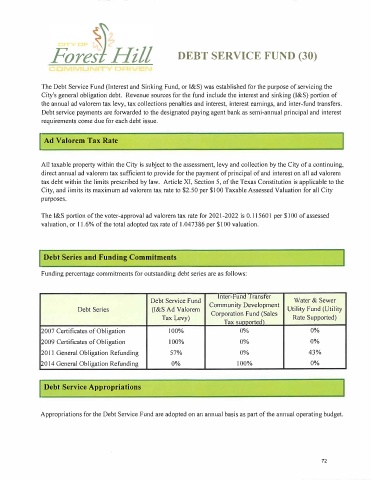

I Debt Series and Funding Commitments

Funding percentage commitments for outstanding debt series are as follows:

Inter-Fund Transfer

Debt Service Fund Water & Sewer

Debt Series (I&S Ad Valorem Community Development Utility Fund (Utility

Corporation Fund (Sales

Tax Levy) Rate Supported)

Tax sunnorted)

2007 Certificates of Obligation 100% 0% 0%

2009 Certificates of Obligation 100% 0% 0%

2011 General Obligation Refunding 57% 0% 43%

2014 General Obligation Refunding 0% 100% 0%

I Debt Service Appropriations

Appropriations for the Debt Service Fund are adopted on an annual basis as part of the annual operating budget.

72