Page 59 - City of Colleyville FY22 Adopted Budget

P. 59

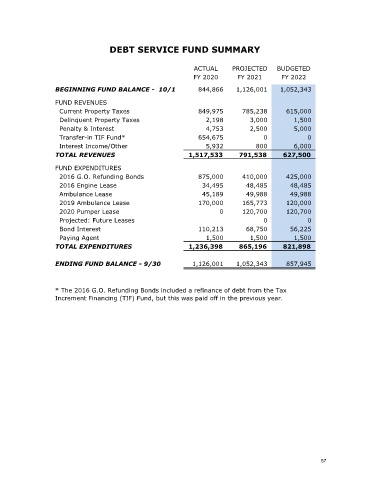

DEBT SERVICE FUND SUMMARY

ACTUAL PROJECTED BUDGETED

FY 2020 FY 2021 FY 2022

BEGINNING FUND BALANCE - 10/1 844,866 1,126,001 1,052,343

FUND REVENUES

Current Property Taxes 849,975 785,238 615,000

Delinquent Property Taxes 2,198 3,000 1,500

Penalty & Interest 4,753 2,500 5,000

Transfer-in TIF Fund* 654,675 0 0

Interest Income/Other 5,932 800 6,000

TOTAL REVENUES 1,517,533 791,538 627,500

FUND EXPENDITURES

2016 G.O. Refunding Bonds 875,000 410,000 425,000

2016 Engine Lease 34,495 48,485 48,485

Ambulance Lease 45,189 49,988 49,988

2019 Ambulance Lease 170,000 165,773 120,000

2020 Pumper Lease 0 120,700 120,700

Projected: Future Leases 0 0

Bond Interest 110,213 68,750 56,225

Paying Agent 1,500 1,500 1,500

TOTAL EXPENDITURES 1,236,398 865,196 821,898

ENDING FUND BALANCE - 9/30 1,126,001 1,052,343 857,945

* The 2016 G.O. Refunding Bonds included a refinance of debt from the Tax

Increment Financing (TIF) Fund, but this was paid off in the previous year.

57