Page 56 - City of Colleyville FY22 Adopted Budget

P. 56

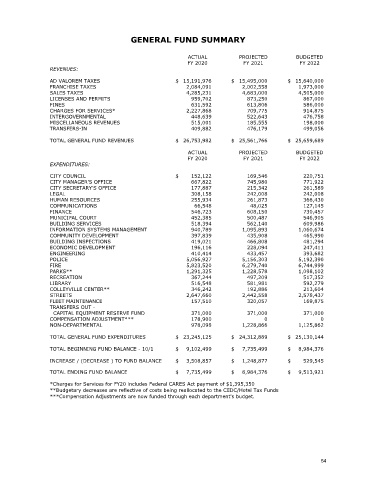

GENERAL FUND SUMMARY

ACTUAL PROJECTED BUDGETED

FY 2020 FY 2021 FY 2022

REVENUES:

AD VALOREM TAXES $ 15,191,976 $ 15,495,000 $ 15,640,000

FRANCHISE TAXES 2,084,091 2,002,558 1,973,000

SALES TAXES 4,285,231 4,683,000 4,505,000

LICENSES AND PERMITS 959,702 873,250 867,000

FINES 631,592 613,806 586,000

CHARGES FOR SERVICES* 2,227,868 709,775 914,875

INTERGOVERNMENTAL 448,639 522,643 476,758

MISCELLANEOUS REVENUES 515,001 185,555 198,000

TRANSFERS-IN 409,882 476,179 499,056

TOTAL GENERAL FUND REVENUES $ 26,753,982 $ 25,561,766 $ 25,659,689

ACTUAL PROJECTED BUDGETED

FY 2020 FY 2021 FY 2022

EXPENDITURES:

CITY COUNCIL $ 152,122 169,546 220,751

CITY MANAGER'S OFFICE 667,822 745,980 771,922

CITY SECRETARY'S OFFICE 177,887 215,342 261,589

LEGAL 308,158 242,008 242,008

HUMAN RESOURCES 255,934 261,873 366,430

COMMUNICATIONS 66,548 48,025 127,145

FINANCE 546,723 608,150 730,457

MUNICIPAL COURT 452,385 500,487 546,905

BUILDING SERVICES 518,394 562,140 609,986

INFORMATION SYSTEMS MANAGEMENT 940,789 1,095,893 1,060,674

COMMUNITY DEVELOPMENT 397,839 435,908 465,990

BUILDING INSPECTIONS 419,021 466,808 481,294

ECONOMIC DEVELOPMENT 196,116 228,094 247,411

ENGINEERING 410,414 433,457 393,682

POLICE 5,056,927 5,156,303 5,192,390

FIRE 5,823,520 6,279,740 6,744,999

PARKS** 1,291,325 1,228,578 1,098,102

RECREATION 367,244 497,209 517,352

LIBRARY 516,548 581,981 592,279

COLLEYVILLE CENTER** 346,242 192,886 213,604

STREETS 2,647,660 2,442,558 2,578,437

FLEET MAINTENANCE 157,510 320,057 169,875

TRANSFERS OUT -

CAPITAL EQUIPMENT RESERVE FUND 371,000 371,000 371,000

COMPENSATION ADJUSTMENT*** 178,900 0 0

NON-DEPARTMENTAL 978,098 1,228,866 1,125,862

TOTAL GENERAL FUND EXPENDITURES $ 23,245,125 $ 24,312,889 $ 25,130,144

TOTAL BEGINNING FUND BALANCE - 10/1 $ 9,102,499 $ 7,735,499 $ 8,984,376

INCREASE / (DECREASE ) TO FUND BALANCE $ 3,508,857 $ 1,248,877 $ 529,545

TOTAL ENDING FUND BALANCE $ 7,735,499 $ 8,984,376 $ 9,513,921

*Charges for Services for FY20 includes Federal CARES Act payment of $1,395,350

**Budgetary decreases are reflective of costs being reallocated to the CEDC/Hotel Tax Funds

***Compensation Adjustments are now funded through each department's budget.

54