Page 63 - City of Colleyville FY22 Adopted Budget

P. 63

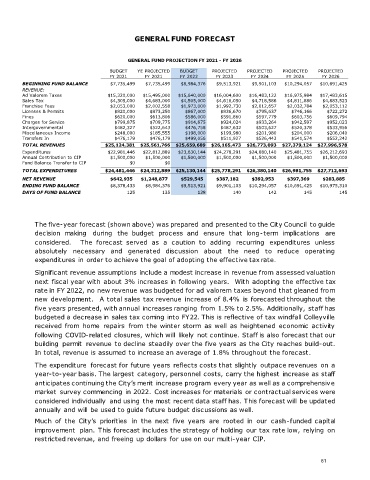

GENERAL FUND FORECAST

GENERAL FUND PROJECTION FY 2021 - FY 2026

BUDGET YE PROJECTED BUDGET PROJECTED PROJECTED PROJECTED PROJECTED

FY 2021 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025 FY 2026

BEGINNING FUND BALANCE $7,735,499 $7,735,499 $8,984,376 $9,513,921 $9,901,103 $10,294,057 $10,691,425

REVENUE:

Ad Valorem Taxes $15,320,000 $15,495,000 $15,640,000 $16,004,600 $16,483,122 $16,975,984 $17,483,615

Sales Tax $4,305,000 $4,683,000 $4,505,000 $4,616,050 $4,718,586 $4,811,886 $4,883,523

Franchise Fees $2,053,000 $2,002,558 $1,973,000 $1,992,730 $2,012,657 $2,032,784 $2,053,112

Licenses & Permits $820,000 $873,250 $867,000 $836,670 $795,637 $746,166 $722,272

Fines $620,000 $613,806 $586,000 $591,860 $597,779 $603,756 $609,794

Charges for Service $799,875 $709,775 $914,875 $924,024 $933,264 $942,597 $952,023

Intergovernmental $482,327 $522,643 $476,758 $487,632 $503,627 $520,378 $533,956

Miscellaneous Income $248,000 $185,555 $198,000 $199,980 $201,980 $204,000 $206,040

Transfers In $476,179 $476,179 $499,056 $511,927 $526,443 $541,574 $552,242

TOTAL REVENUES $25,124,381 $25,561,766 $25,659,689 $26,165,473 $26,773,093 $27,379,124 $27,996,578

Expenditures $22,981,446 $22,812,889 $23,630,144 $24,278,291 $24,880,140 $25,481,755 $26,212,693

Annual Contribution to CIP $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Fund Balance Transfer to CIP $0 $0

TOTAL EXPENDITURES $24,481,446 $24,312,889 $25,130,144 $25,778,291 $26,380,140 $26,981,755 $27,712,693

NET REVENUE $642,935 $1,248,877 $529,545 $387,182 $392,953 $397,369 $283,885

ENDING FUND BALANCE $8,378,433 $8,984,376 $9,513,921 $9,901,103 $10,294,057 $10,691,425 $10,975,310

DAYS OF FUND BALANCE 125 135 138 140 142 145 145

The five-year forecast (shown above) was prepared and presented to the City Council to guide

decision making during the budget process and ensure that long-term implications are

considered. The forecast served as a caution to adding recurring expenditures unless

absolutely necessary and generated discussion about the need to reduce operating

expenditures in order to achieve the goal of adopting the effective tax rate.

Significant revenue assumptions include a modest increase in revenue from assessed valuation

next fiscal year with about 3% increases in following years. With adopting the effective tax

rate in FY 2022, no new revenue was budgeted for ad valorem taxes beyond that gleaned from

new development. A total sales tax revenue increase of 8.4% is forecasted throughout the

five years presented, with annual increases ranging from 1.5% to 2.5%. Additionally, staff has

budgeted a decrease in sales tax coming into FY22. This is reflective of tax windfall Colleyville

received from home repairs from the winter storm as well as heightened economic activity

following COVID-related closures, which will likely not continue. Staff is also forecast that our

building permit revenue to decline steadily over the five years as the City reaches build-out.

In total, revenue is assumed to increase an average of 1.8% throughout the forecast.

The expenditure forecast for future years reflects costs that slightly outpace revenues on a

year-to-year basis. The largest category, personnel costs, carry the highest increase as staff

anticipates continuing the City’s merit increase program every year as well as a comprehensive

market survey commencing in 2022. Cost increases for materials or contractual services were

considered individually and using the most recent data staff has. This forecast will be updated

annually and will be used to guide future budget discussions as well.

Much of the City’s priorities in the next five years are rooted in our cash-funded capital

improvement plan. This forecast includes the strategy of holding our tax rate low, relying on

restricted revenue, and freeing up dollars for use on our multi-year CIP.

61