Page 28 - Watauga FY21 Budget

P. 28

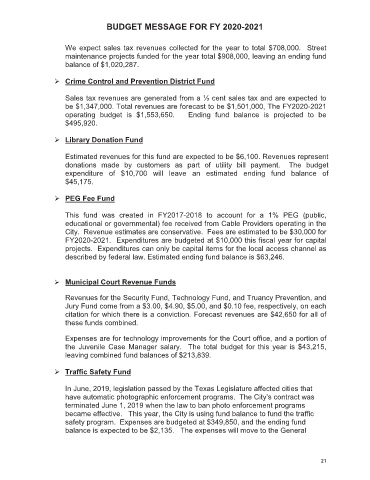

BUDGET MESSAGE FOR FY 2020-2021

We expect sales tax revenues collected for the year to total $708,000. Street

maintenance projects funded for the year total $908,000, leaving an ending fund

balance of $1,020,287.

¾ Crime Control and Prevention District Fund

Sales tax revenues are generated from a ½ cent sales tax and are expected to

be $1,347,000. Total revenues are forecast to be $1,501,000, The FY2020-2021

operating budget is $1,553,650. Ending fund balance is projected to be

$495,920.

¾ Library Donation Fund

Estimated revenues for this fund are expected to be $6,100. Revenues represent

donations made by customers as part of utility bill payment. The budget

expenditure of $10,700 will leave an estimated ending fund balance of

$45,175.

¾ PEG Fee Fund

This fund was created in FY2017-2018 to account for a 1% PEG (public,

educational or governmental) fee received from Cable Providers operating in the

City. Revenue estimates are conservative. Fees are estimated to be $30,000 for

FY2020-2021. Expenditures are budgeted at $10,000 this fiscal year for capital

projects. Expenditures can only be capital items for the local access channel as

described by federal law. Estimated ending fund balance is $63,246.

¾ Municipal Court Revenue Funds

Revenues for the Security Fund, Technology Fund, and Truancy Prevention, and

Jury Fund come from a $3.00, $4.90, $5.00, and $0.10 fee, respectively, on each

citation for which there is a conviction. Forecast revenues are $42,650 for all of

these funds combined.

Expenses are for technology improvements for the Court office, and a portion of

the Juvenile Case Manager salary. The total budget for this year is $43,215,

leaving combined fund balances of $213,839.

¾ Traffic Safety Fund

In June, 2019, legislation passed by the Texas Legislature affected cities that

have automatic photographic enforcement programs. The City’s contract was

terminated June 1, 2019 when the law to ban photo enforcement programs

became effective. This year, the City is using fund balance to fund the traffic

safety program. Expenses are budgeted at $349,850, and the ending fund

balance is expected to be $2,135. The expenses will move to the General

21