Page 24 - Watauga FY21 Budget

P. 24

BUDGET MESSAGE FOR FY 2020-2021

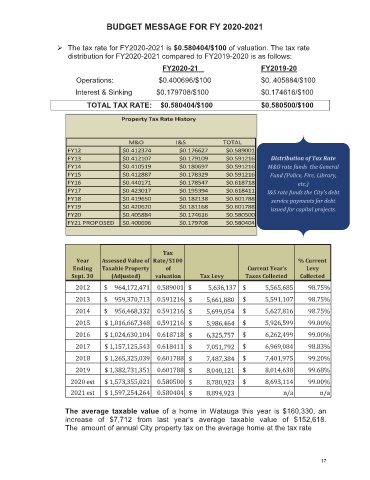

¾ The tax rate for FY2020-2021 is $0.580404/$100 of valuation. The tax rate

distribution for FY2020-2021 compared to FY2019-2020 is as follows:

FY2020-21 FY2019-20

Operations: $0.400696/$100 $0..405884/$100

Interest & Sinking $0.179708/$100 $0.174616/$100

TOTAL TAX RATE: $0.580404/$100 $0.580500/$100

Property Tax Rate History

M&O I&S TOTAL

FY12 $0.412374 $0.176627 $0.589001

FY13 $0.412107 $0.179109 $0.591216 Distribution of Tax Rate

FY14 $0.410519 $0.180697 $0.591216 M&O rate funds the General

FY15 $0.412887 $0.178329 $0.591216 Fund (Police, Fire, Library,

FY16 $0.440171 $0.178547 $0.618718 etc.)

FY17 $0.423017 $0.195394 $0.618411 I&S rate funds the City’s debt

FY18 $0.419650 $0.182138 $0.601788 service payments for debt

FY19 $0.420620 $0.181168 $0.601788 issued for capital projects.

FY20 $0.405884 $0.174616 $0.580500

FY21 PROPOSED $0.400696 $0.179708 $0.580404

Tax

Year Assessed Value of Rate/$100 % Current

Ending Taxable Property of Current Year's Levy

Sept. 30 (Adjusted) valuation Tax Levy Taxes Collected Collected

2012 $ 964,172,471 0.589001 $ 5,636,137 $ 5,565,685 98.75%

2013 $ 959,370,713 0.591216 $ 5,661,880 $ 5,591,107 98.75%

2014 $ 956,468,332 0.591216 $ 5,699,054 $ 5,627,816 98.75%

2015 $ 1,016,667,348 0.591216 $ 5,986,464 $ 5,926,599 99.00%

2016 $ 1,024,630,104 0.618718 $ 6,325,757 $ 6,262,499 99.00%

2017 $ 1,157,125,543 0.618411 $ 7,051,792 $ 6,969,084 98.83%

2018 $ 1,265,325,039 0.601788 $ 7,487,384 $ 7,401,975 99.20%

2019 $ 1,382,731,351 0.601788 $ 8,040,121 $ 8,014,638 99.68%

2020 est $ 1,573,355,021 0.580500 $ 8,780,923 $ 8,693,114 99.00%

2021 est $ 1,597,254,264 0.580404 $ 8,894,923 n/a n/a

The average taxable value of a home in Watauga this year is $160,330, an

increase of $7,712 from last year’s average taxable value of $152,618.

The amount of annual City property tax on the average home at the tax rate

17